Stellantis, a empresa recém -formada após a fusão da montadora francesa Groupe PSA e da Fiat Chrysler Automobiles, agora possui um portfólio de mais de 15 marcas para gerenciar. Quais marcas devem manter e onde? Portfólio:

Given the close positioning and nature of some of the brands in the portfolio, we decided to use our data to take a hypothetical look at what might be the benefits of a portfolio rationalisation.

Our analysis for the scope of this piece focused on France and our research covered the following brands in Stellantis portfolio:

- Peugeot

- Renault

- Citroen

- Opel

- Fiat

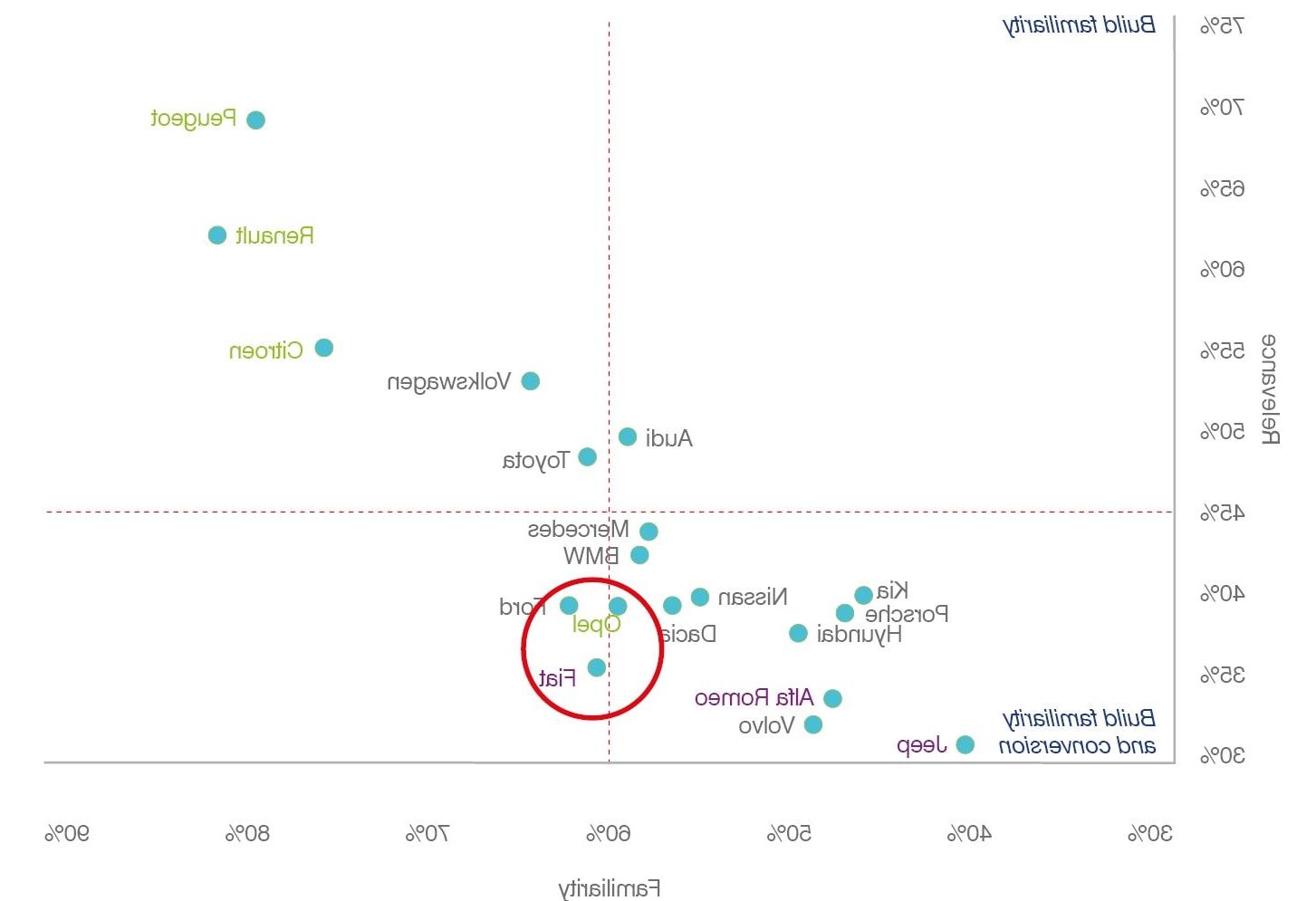

- ALFA ROMEO | MELHEMENTE ASSIMENTO DE ASSIMENTO ASSIMENTO EMMATO ASSIMENTO EMMIMATIVO DO ROMEO | No nível de familiaridade e relevância (consideração entre os familiares), que são altos preditores de futuras vendas e participação de mercado, conforme mostrado em nosso recente relatório de Brandbeta. Naturalmente, as marcas PSA com herança significativa na França têm um desempenho muito melhor do que as marcas da FCA em ambas as medidas. Ao mesmo tempo, Fiat e Opel têm níveis semelhantes de familiaridade e relevância no mercado, mas a Opel parece ter uma pequena vantagem. Se as marcas estiverem posicionadas de maneira semelhante nas mentes dos clientes, é provável que haja sobreposição significativa em termos dos clientes interessados em comprar uma ou outra marca - reduzindo a eficiência de marketing e vendas. Mais uma vez, Fiat e Opel parecem ser pares próximos com posicionamento muito semelhante, concentrados principalmente em torno da facilidade e valor ao dinheiro. Fiat

- Jeep

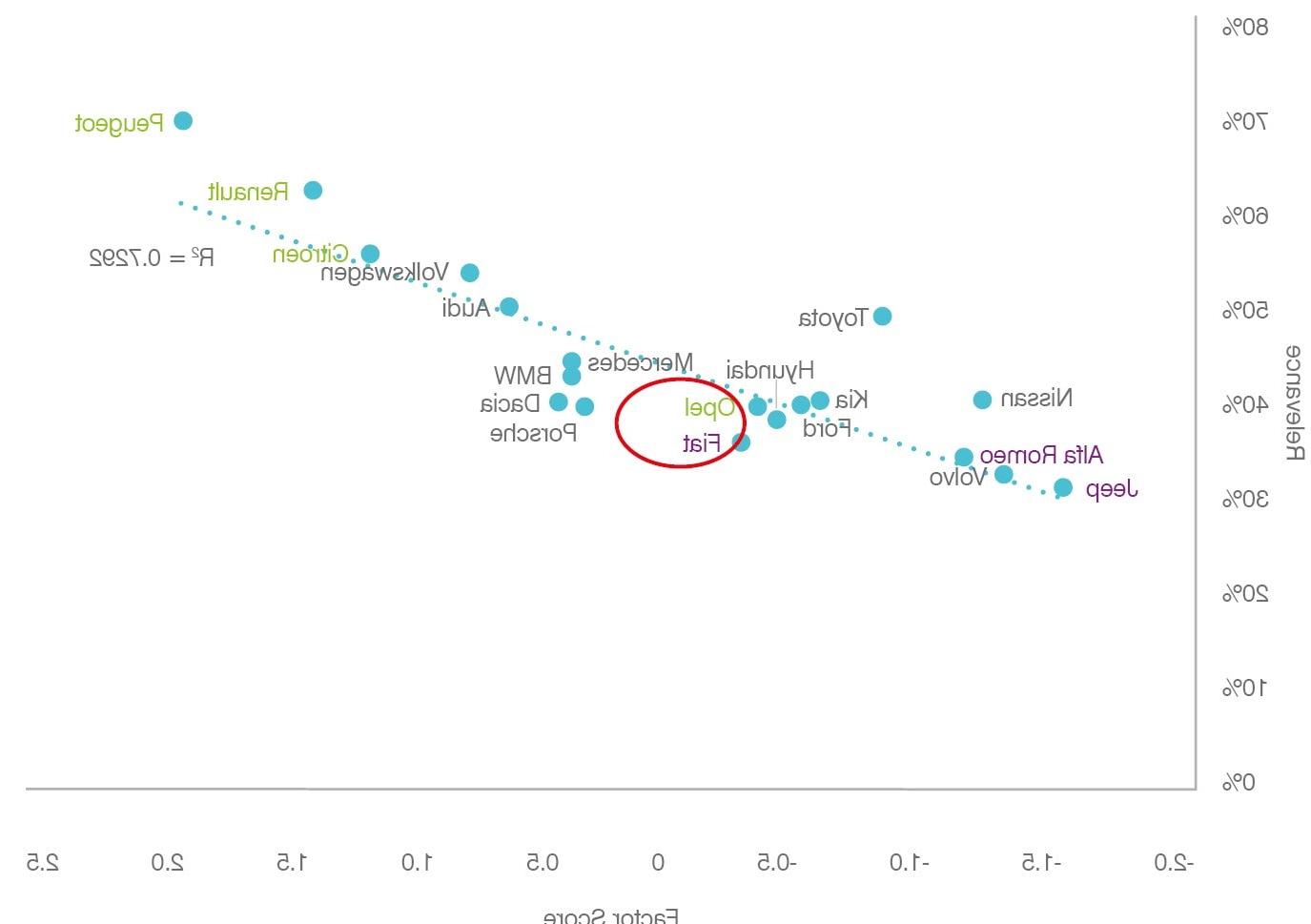

As a first step, we had a look at the level of familiarity and relevance (consideration among those familiar) which are high predictors of future sales and market share, as shown in our recent BrandBeta report. Naturally, the PSA brands with significant heritage in France perform much better than the FCA brands on both measures. At the same time, Fiat and Opel have similar levels of familiarity and relevance in the market, but Opel seems to have a slight edge.

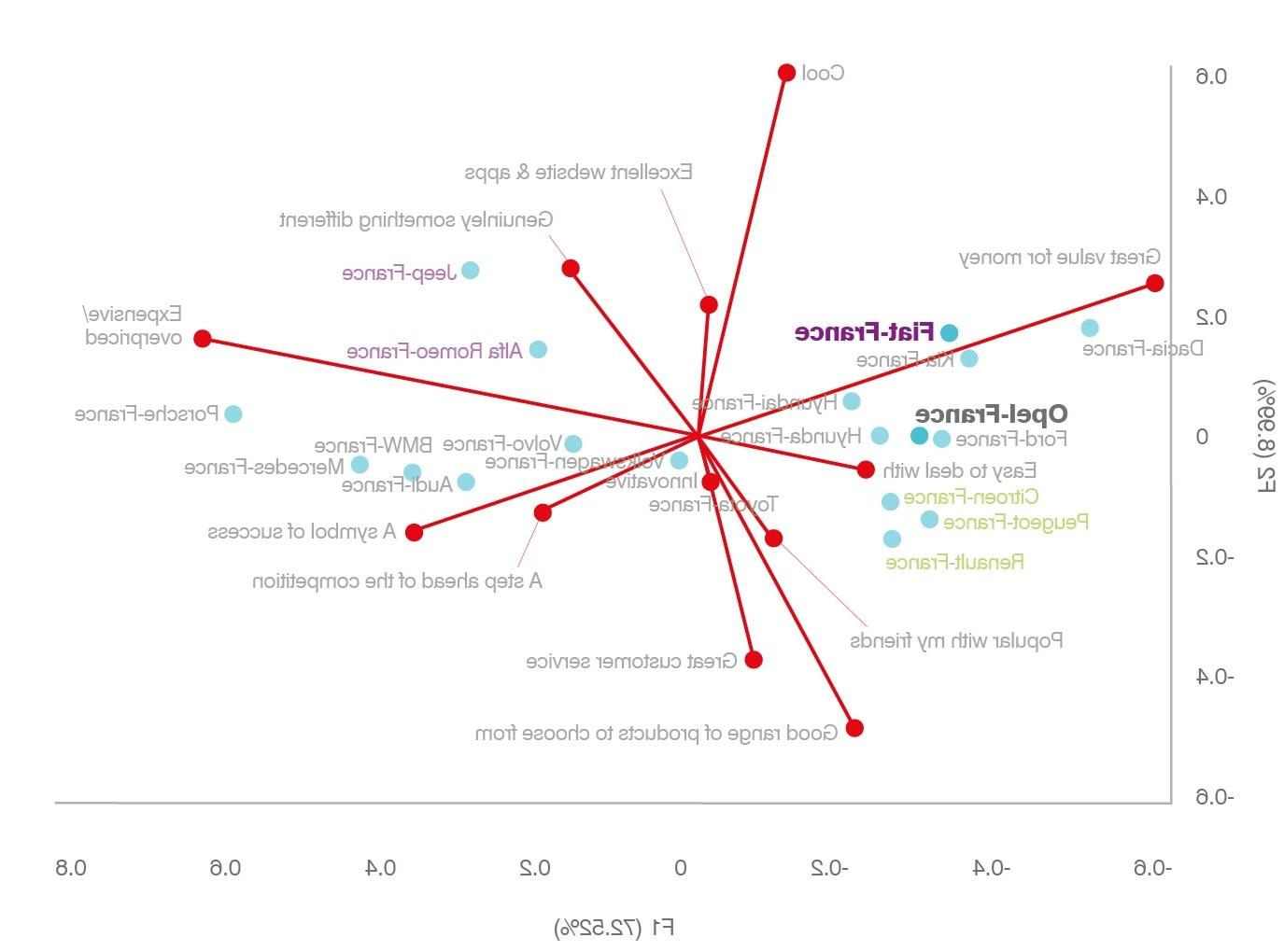

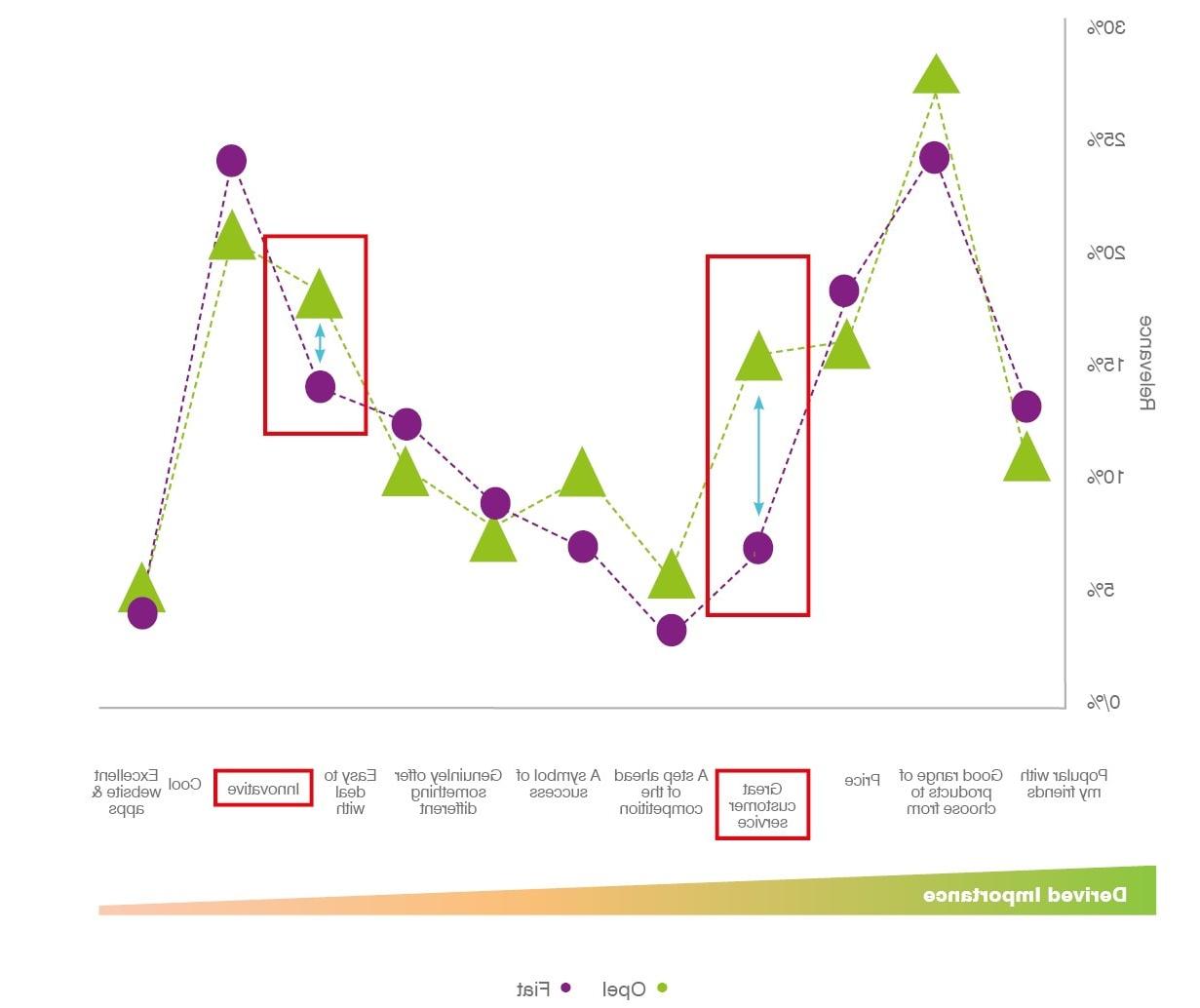

As a second step, we looked at brand positioning in the market, another key driver behind relevance. If brands are positioned in a similar way in the minds of customers, there is likely to be significant overlap in terms of the customers interested in buying one or the other brand – reducing the efficiency of marketing and sales. Once again, Fiat and Opel appear to be close peers with very similar positioning, mainly concentrated around easiness and value for money.

Based on the above analysis we inferred that Opel and Fiat in France have:

- Similar level of familiarity and relevance with Opel slightly beating Fiat

- Um posicionamento muito semelhante no mercado, portanto, uma alta cruzamento de segmentos potenciais de clientes

Melhorar a familiaridade e a relevância entre os consumidores é essencial para melhorar a participação de mercado. A relevância é influenciada pelos atributos da marca para diferentes graus. O que, portanto, decidimos encontrar foi: o que está impulsionando a relevância no mercado?

Interessado em aprender mais sobre o setor? Encontre os desenvolvimentos mais recentes no mundo automático aqui. Amigos

Analysing this, we found that one of the top dimensions in driving relevance in the mass market segment are what we could call “Customer Focus” attributes, those being:

- Great customer service

- Good range of products

- Popular with my friends

Grandes vencedores nesta dimensão são Peugeot, Renault e Citroen. Opel e Fiat estão novamente posicionados de perto nessa dimensão, o que significa que as pessoas veem essas marcas de maneira semelhante nos mesmos atributos mostrados. Enquanto na maioria dos atributos, as marcas estavam alinhadas nas percepções do consumidor, em 2 métricas Opel pontuou melhor que Fiat:

We had a look at how Opel and Fiat scored on each of the different image attributes researched to understand what the key strength and weaknesses for these brands in a 1 vs 1 situation were. While on most of the attributes the brands were aligned in consumer perceptions, on 2 metrics Opel scored better than Fiat: Grande atendimento ao cliente e Inovação percebida. Como mostrado no gráfico acima, o ótimo atendimento ao cliente foi um dos principais direcionadores de relevância. Para o gerenciamento de portfólio de marcas e a otimização de investimentos, é de uso claro para empresas que tentam alcançar uma maior eficiência de marketing e obter sinergias sensatas que, em última análise, é o que se trata fusões.

In summary, while other strategic considerations would need to be taken into account in order to proceed with an investment or a portfolio rationalization, we believe there are compelling reasons exposed by our data to suggest there are benefits from a rationalisation.

This analytical approach to brand portfolio management and investment optimisation is of clear use for companies trying to reach a higher marketing efficiency and obtaining sensible synergies which ultimately, is what mergers are all about.