O papel do setor bancário na crise financeira das marcas bancárias de custo de 2008/09 e sua reputação. Agora, pela primeira vez desde a Grande Recessão, a reputação das marcas bancárias está em ascensão mais uma vez. Hero

From Villain to Hero

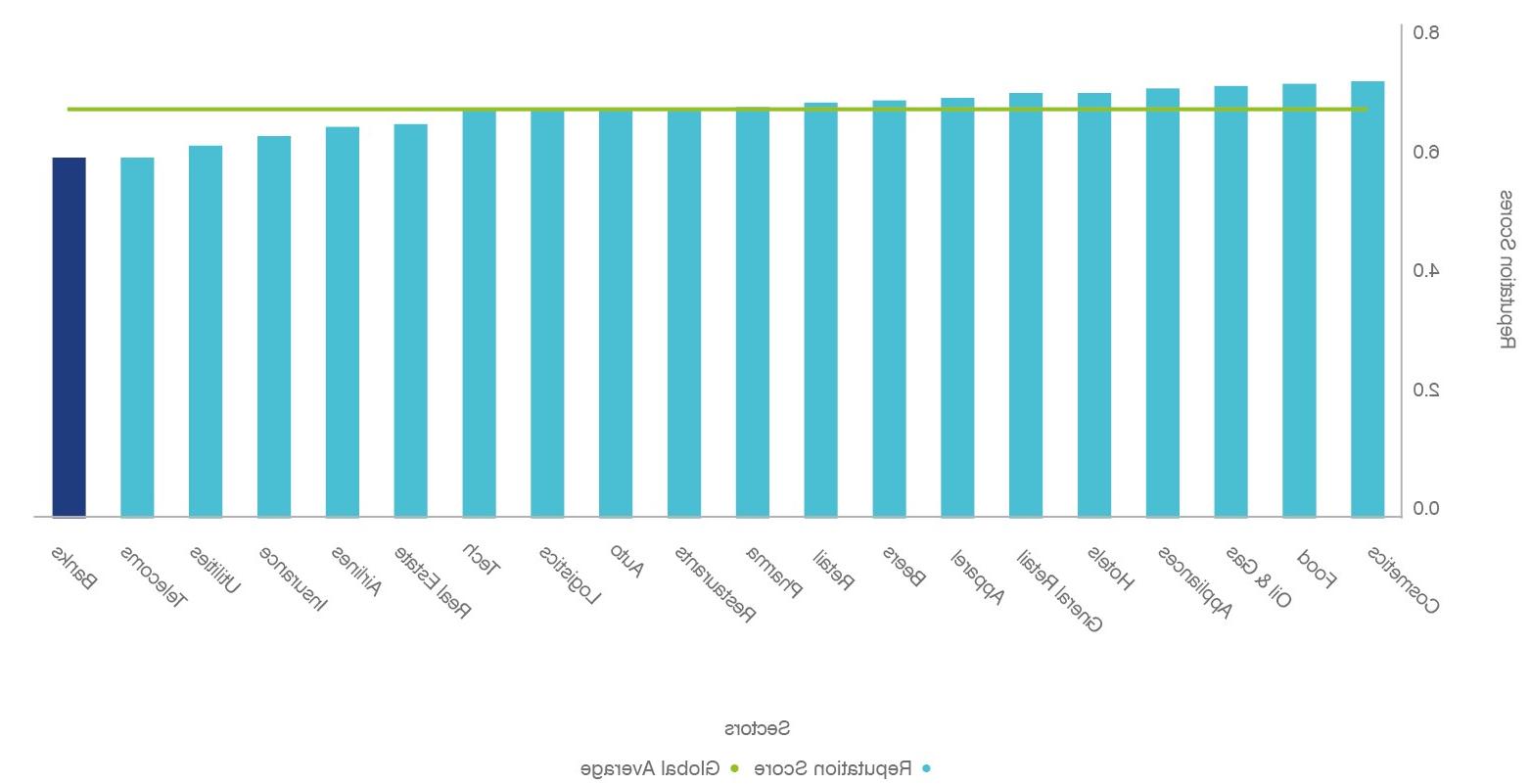

Marcas bancárias não são de forma alguma líderes de reputação. De fato, de acordo com a pesquisa realizada pelo Finanças da marca em 2020, a indústria bancária em classificação agregada é a última das 20 indústrias pesquisadas globalmente:

Since 2008-09, banks have not done themselves any favours. From fictitious-accounts1 to money-laundering2 there have been numerous instances of some of the largest banks in the world behaving in a less than flattering manner.

Apart from the widespread scandals, anecdotally everyone has a story about long queues in branches, less than Níveis satisfatórios de atendimento ao cliente e pontos de dor em torno de pedidos de empréstimo. O resultado líquido é uma sensação maior de boa vontade para os bancos entre os consumidores. We have measured an average increase in the reputation of banking brands in 27 of the 29 countries surveyed by Brand Finance

However, over the past 12 months, and since the onset of the COVID-19 pandemic globally, we have seen banking brands play a hugely significant role in helping businesses and consumers overcome the effects of the virus - distributing government-mandated funds, extending credit, reducing fees, and being considerate to customers. The net result is a greater feeling of goodwill for banks among consumers. We have measured an average increase in the reputation of banking brands in 27 of the 29 countries surveyed by Brand Finance 3

Due to strong regulatory measures put in place by governments, central banks, and the Basel Committee on Banking Supervisions (BCBS), the global banking industry is far better equipped to provide the necessary support to the economies in which they operate than during the Global Financial Crise. Banco de dados

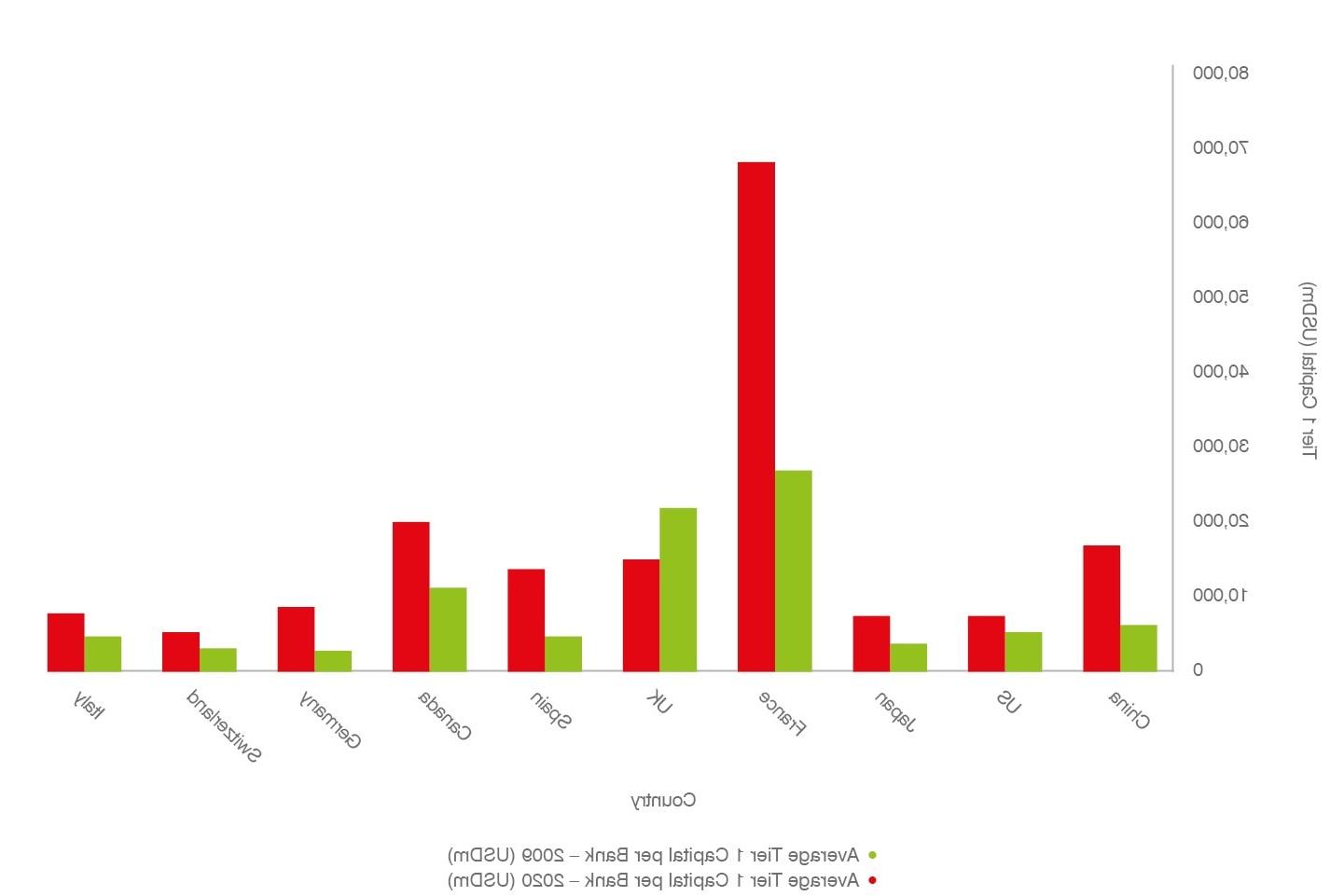

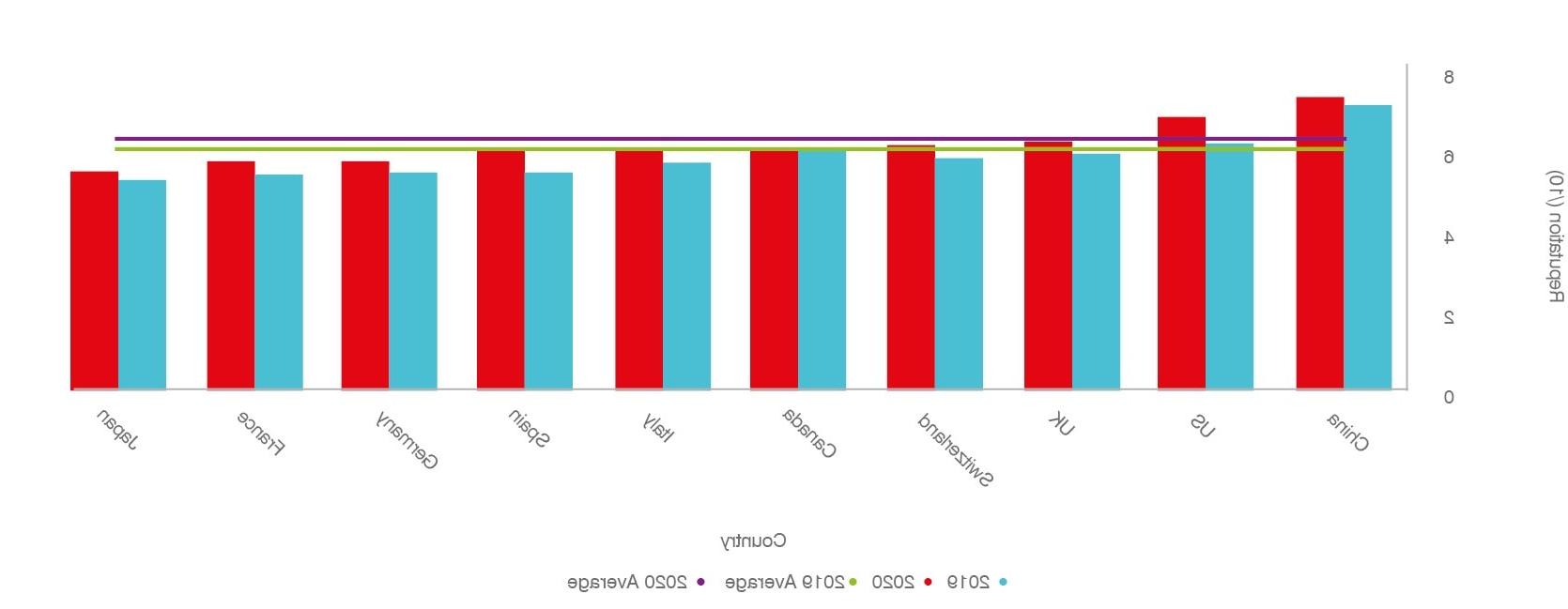

For example, looking at the average Tier 1 Capital (which is a core measure of a bank’s financial strength) and focussing on the countries with the largest banking industries in the world, we can see the banks operating in each country have increased Tier 1 Capital substantially since 2009 (except for the UK):

Ameaças de reputação

Apesar de estar melhor equipado financeiramente para lidar com a crise atual, as marcas bancárias enfrentam uma grande ameaça representada pelo início do covid-19 e as consequências do pandemia de 15 anos = 155) e as contas de 15h. e Bancos Challenger

- Persistently low-interest rates

- Stronger regulation

- Increased competition from fintech and challenger banks

- Revisando sistemas legados caros.

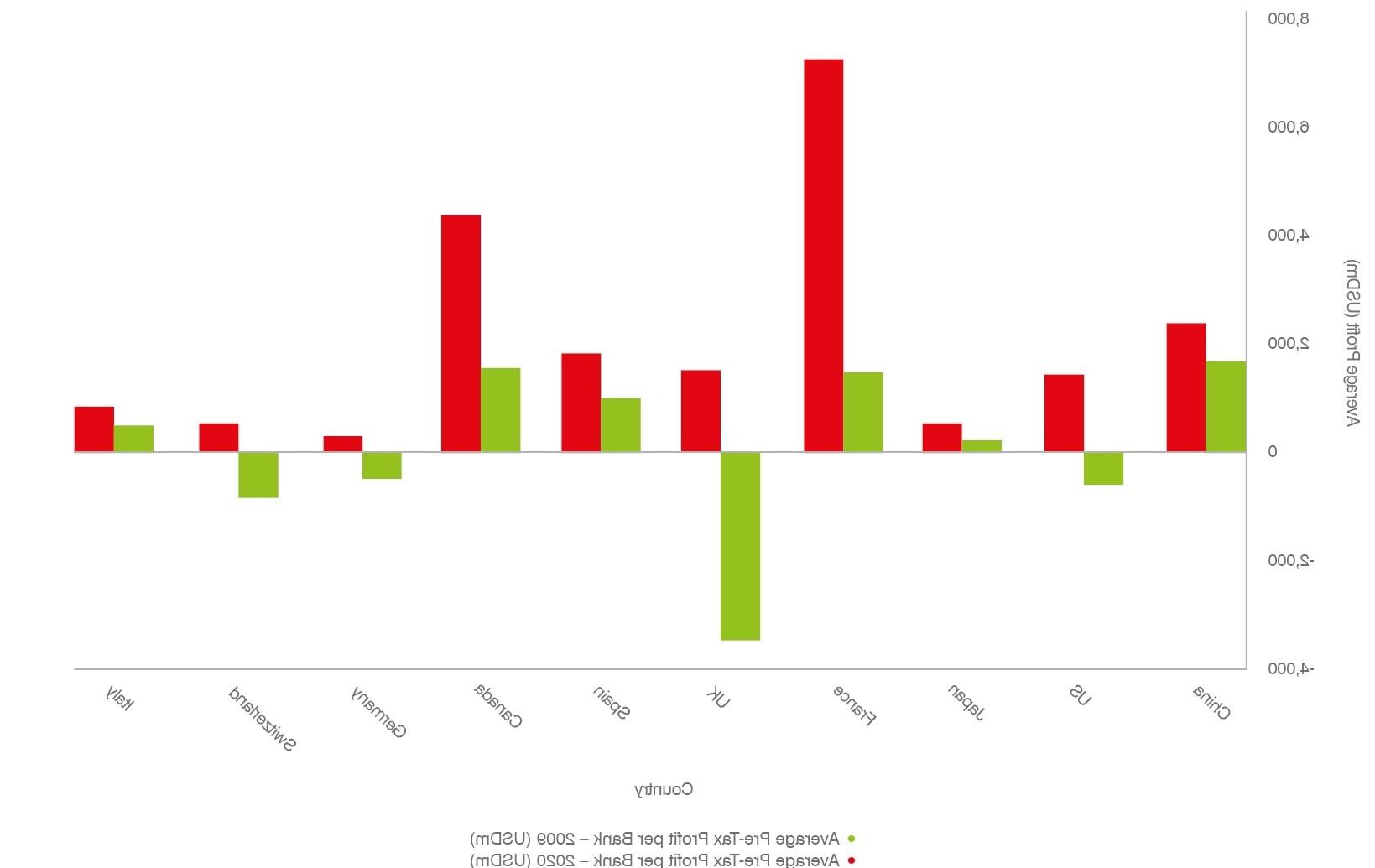

Marcas bancárias estão operando em um ambiente muito mais desafiador nos últimos anos. Embora o lucro médio por marca bancária tenha se recuperado desde imediatamente após a crise financeira global, ainda existem muitas pressões externas significativas. Como muitas marcas bancárias estenderam grandes linhas de crédito a consumidores e empresas angustiados, elas correm risco de que os reembolsos de empréstimos não sejam feitos. melhorando? Avaliando os mesmos 10 países acima, as pontuações de reputação aumentaram em média 4%. Pode -se argumentar que esse não é um aumento significativo, mas o que é significativo é o dos 29 países pesquisados pelo financiamento da marca, 27 estão experimentando aumentos de reputação no setor bancário.

This squeeze on profits is exasperated by the role the industry has played in supporting local economies. Because many banking brands have extended large lines of credit to distressed consumers and businesses, they are at risk of loan repayments not being made.

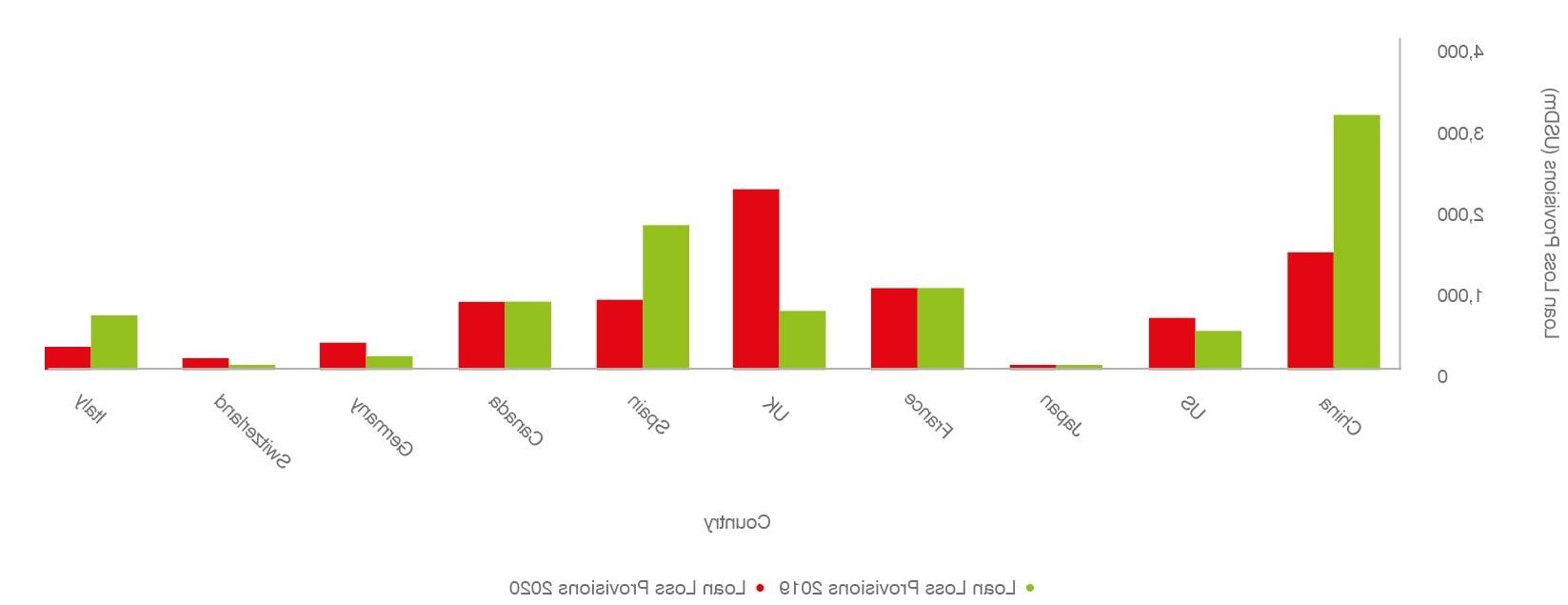

For example, within the Brand Finance Banking 500 2021 report, on average US banks have increased loan loss provisions by 130% year-on-year:

Why is reputation improving?

Reputation across the banking industry is rising for the first time since Brand Finance begun its Global Brand Equity Monitor. Assessing the same 10 countries as above, Reputation scores have increased by an average of 4%. It may be argued that this is not a significant increase, yet what is significant is that of the 29 countries researched by Brand Finance, 27 are experiencing reputational increases in the banking industry.

Usando pesquisas em mais de 500 marcas em todo o mundo, o financiamento da marca usou análise estatística para identificar 3 áreas -chave que determinam a reputação entre as marcas bancárias, estas são: || 180

- The ability to meet the customer’s needs

- Practising ethically and sustainably

- Inovação

Pontuações de pesquisa em cada uma dessas categorias melhoraram ano a ano em média em todo o setor. De acordo com a pesquisa, os seguintes atributos são cruciais entre os consumidores ao selecionar uma marca bancária:

So, what does the ability to meet the needs of the customer entail? According to the research, the following attributes are crucial among consumers when selecting a banking brand:

- Sendo fácil de lidar com

- Ter um bom site e aplicativo

- Accessibility

- Good levels of customer service

- Good product range

- Good value for money

These are all relatively intuitive when thinking about what the customer desires and it appears banking brands (spurred on by the pandemic) are performing better in this regard.

Ethical practices are a natural fit in determining reputation and consist of caring about the wider community in which the bank operates in, being transparent, being committed to sustainability, and being fair to all people. Again, government-mandated or not, banking brands are scoring better in this regard because of the pandemic.

Innovation has been the major buzzword in the banking industry in recent years (and in many other industries). However, innovation for innovation’s sake can be counterproductive.

The reason digital banks perform exceptionally well in Brand Finance’s Global Brand Equity Monitor is that their innovations enable them to meet the customers’ needs in an efficient and effective manner. This ability has come to the fore throughout the pandemic, where banks with greater digital capabilities are better placed to serve customers through innovation.

Indeed, the onset of the pandemic has forced brands that were previously falling behind in digitalisation and innovation to invest and act at speed or risk losing market share.

DBS bank (6 th Marca bancária mais forte do mundo 4) reagiu extremamente rapidamente quando o vírus começou a se espalhar em Singapura, lançando um pacote de relevo digital, permitindo muitos varejistas para configurar online, em 21 dias.

As another example, Maybank (8 TH A marca bancária mais forte do mundo) lançou um processo de aprovação de 10 minutos digital de 10 minutos para financiamento para PMEs durante a Pandemic, e até o momento, a REPUTUTION de 99% é de todos os seus relatos de empréstimos processados. A pesquisa é:

Why Reputation is Important

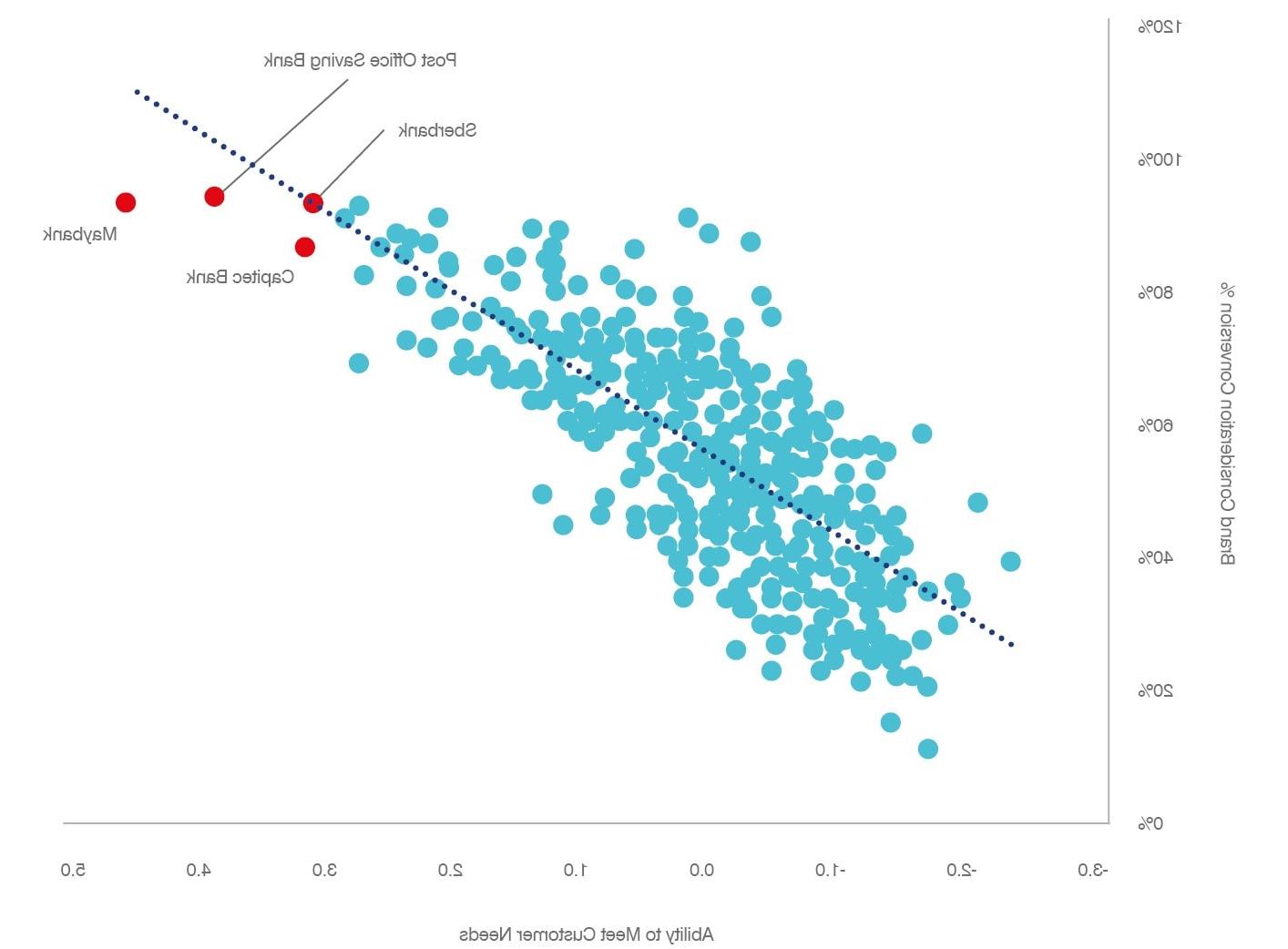

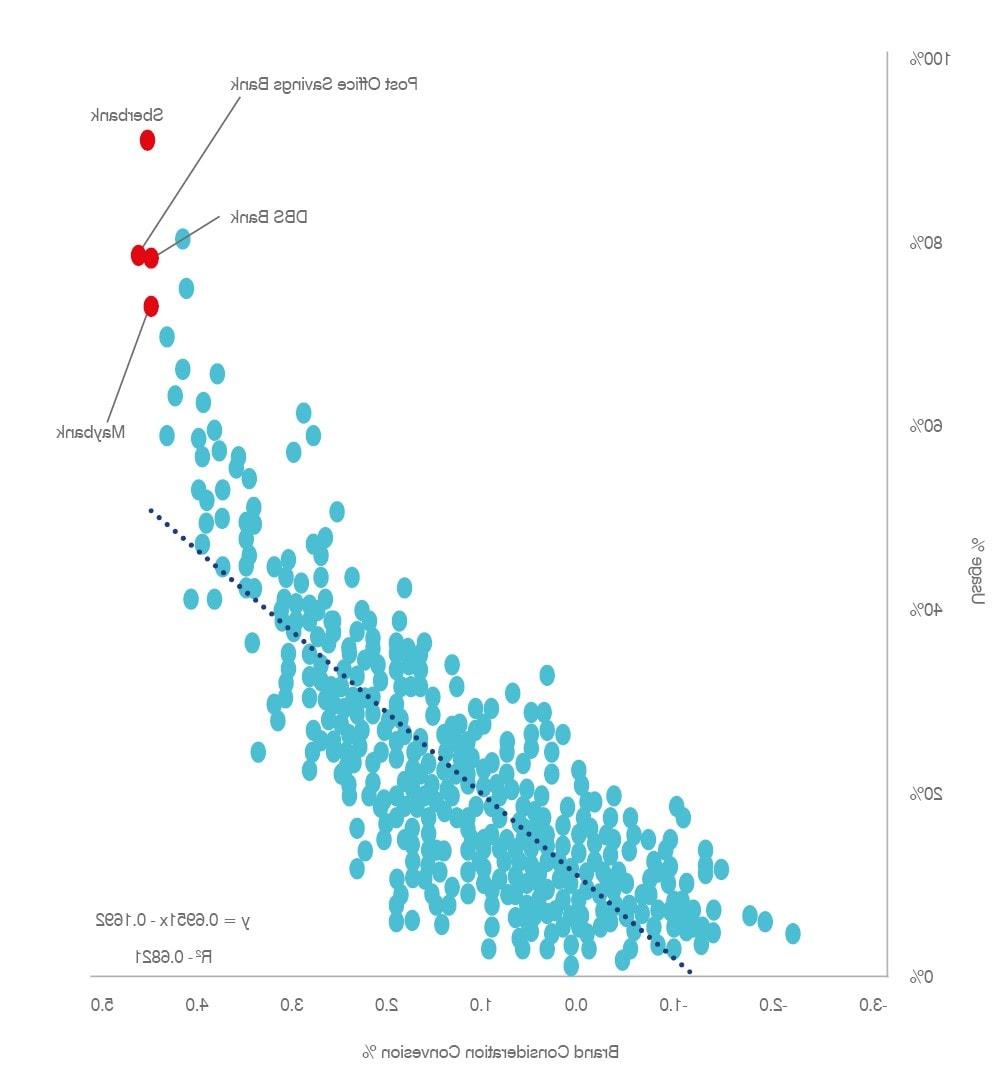

The five most reputable banking brands indicated by the research are: Revolut (Reino Unido), DBS Bank (Cingapura), Banco de economia dos correios (Cingapura), Maybank (Malaysia) e || 227 Capitec Bank (South Africa). Each of these banking brands are among the strongest brands in our study. According to Brand Finance research, Reputation (and the main drivers of Reputation) is highly correlated with brand consideration.

Examining the ability of a bank to meet customer needs, we can see that the banks that outperform in reputation also outperform in brand consideration:

Why is brand consideration important? Brand consideration is highly correlated with brand usage (market share), where increased consideration is a lead indicator of usage:

Our research shows that while building brand reputation is important for any brand (not least those in the banking industry), in the banking sector, focusing on the core offering of identifying what the customer needs and continuing to service those Necessidades, é uma das principais avenidas para fazê -lo. No entanto, um KPI mais importante está construindo a consideração da marca, que é impulsionada principalmente pelo atendimento às necessidades do consumidor.

A consideração da marca pode ser auxiliada pela inovação, que não é por si só um fator -chave da consideração da marca, mas desempenha um papel crucial na capacidade de um banco se conectar com seus clientes durante uma pandemia. Se uma marca bancária sair do outro lado da pandemia em uma posição mais forte no mercado, ela deve usar pesquisas, análises e pontos de dados semelhantes para ajudar a orientar a tomada de decisões importantes, não apenas no departamento de marketing, mas em todo o negócio.

References

- 'The Wells Fargo Fake Account Scandal', https: //www.nytimes.com/2020/02/21/business/wells-pargo-settlement.html↩

- Royal Commission into the behaviour of Australia’s biggest banks, https: //financialservices.royalcommission.gov.au/pages/default.aspx ↩

- Monitor global de equidade global da marca Global Monitor 2020 Ahernhttps://brandirectory.com/consumer-research↩

- https://brandirectory.com/rankings/global/↩