Chairman,

Brand Finance

2025 is a big year for China’s nation brand. China is now the second-most powerful nation in the world in terms of Soft Power, surpassing the United Kingdom and second only to the U.S. China’s second-place spot in the ranking is its highest performance since Brand Finance began researching perceptions of nation brands.

Their ascent is not due to luck; China has made deliberate and multifaceted efforts to address weaknesses in how the country is perceived. The data indicates the strategy is working, as China’s Reputation has climbed to 27th rank, up from 56th in 2021.

In the past year, China’s nation brand has experienced notable growth across six of eight Soft Power pillars and in two-thirds of measured attributes. This growth highlights how improved perceptions across a range of economic, cultural, and social metrics are driving China’s Soft Power.

In the meantime, the United Kingdom has stumbled. The UK is now ranked third in the Global Soft Power Index for the first time since the pandemic. While its scores and ranks have remained relatively stable year-on-year, there is a noticeable plateau in perceptions of its nation brand. Unlike China’s dynamic upward trajectory, the latest data indicates the UK may be losing momentum in shaping its global image. (Figure 1)

China's growing economic influence: Outpacing the UK in global business and trade?

Brand Finance research highlights that Business & Trade attributes are key indicators of a nation’s global influence, reflecting economic strength, innovation, and integration into the worldwide market.

Since Brand Finance began measuring the nation’s Soft Power in 2020, China has consistently outperformed the UK in the Business & Trade pillar. China has held the top spot globally for ‘ease of doing business since’ 2020, while the UK’s highest rank for this attribute was sixth in 2023.

In 2025, the UK has slipped to eighth place, now trailing significantly behind China. This growing gap reflects China’s sustained efforts to enhance its economic attractiveness and attract foreign investment, while the UK is struggling to stay competitive. In the 2025 Index, China ranks eighth for its ‘strong and stable economy,’ narrowly ahead of the UK, which holds the ninth spot, a drop of two ranks from 2024. This shift reflects China’s growing economic influence and ability to shape global economic stability perceptions. China has also ranked first for its ‘future growth potential’ since 2022, while the UK, which reached a concerningly low 86th in 2023, is struggling to keep up with China’s high growth, improving only to 37th place in 2025.

For the UK, this concerning stagnation highlights a need to reassess its strategies for maintaining economic relevance, especially as it continues to navigate post-Brexit realities, evolving trade dynamics, and domestic pressures. Staying competitive in this crucial pillar of Soft Power will require a renewed focus on innovation, trade relationships, and economic diplomacy.

Positive perceptions of China’s economic growth potential can be largely attributed to initiatives like the Belt and Road Initiative (BRI). The BRI has played a pivotal role in creating new markets for Chinese companies and strengthening economic ties with participating countries. By building infrastructure, enhancing trade routes, and fostering international partnerships, the BRI has positioned China as a key driver of global connectivity.

In terms of Soft Power, a nation’s ability to engage in trade, attract investment, and contribute to global economic development is instrumental in shaping perceptions and enhancing its standing on the world stage.

China's strategic use of initiatives like the BRI has bolstered its economic strength and reinforced its image as a collaborative partner in international development, reflected in a 24-rank jump for its ‘good relations with other countries.’ The UK, meanwhile, remains in 18th place for this attribute, showing no improvement from 2024.

The rise of Chinese brands: From domestic giants to global powerhouses

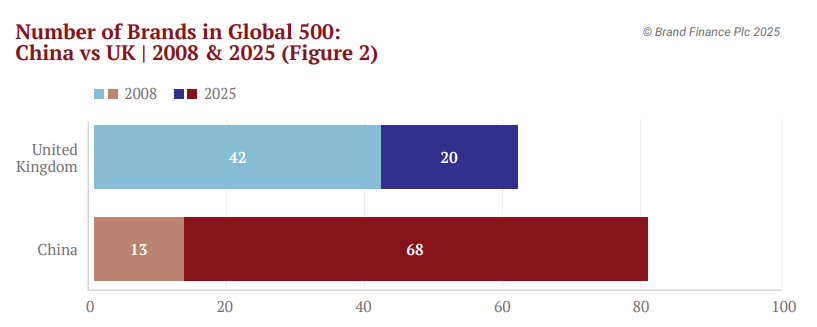

China’s strategic investments in brand building have significantly enhanced the recognition and influence of its brands globally, contributing to the nation’s growing Soft Power. In 2025, China ranks fifth globally for its ‘products and brands the world loves’, while the UK has remained in seventh position since 2021, signalling stagnation in this area. China’s rise in this attribute is largely due to the growing recognition and performance of Chinese brands domestically and globally. Over the past 17 years, the number of Chinese brands in the Brand Finance Global 500 has surged from 13 to 68, and their total brand value has increased by more than 23-fold to USD1.4 trillion. (Figure 2)

This jump in brand value reflects a shift from domestic dominance to global brand leadership, exemplified by the worldwide impact of Chinese brands like TikTok. With over 1 billion monthly users, TikTok has transformed the global media landscape, reshaping how people create, consume and share content on a massive scale.

Its global influence has likely contributed to China’s improved performance in the Media & Communication pillar, climbing 20 ranks for being perceived as ‘easy to communicate with,’ and 13 ranks for having ‘trustworthy media.’

Chinese brands are also at the forefront of global innovation, with China maintaining its position as second in the world for being ‘advanced in technology and innovation’ over the past three years, ahead of the UK in sixth rank.

This progress is powered by the rise of tech giants like Huawei, a leader in global telecommunications, and BYD, which is driving the rapid global shift toward electric vehicles. These advancements reflect China’s growing authority in innovative and high-tech industries and cement the global impact of Chinese brands.

Another standout example is the State Grid Corporation of China (SGCC), which has emerged as a global leader through its pivotal role in the BRI. By developing and operating critical energy infrastructure projects across participating countries, SGCC has not only strengthened China’s energy diplomacy but also bolstered its brand as a leader in energy innovation and sustainable development.

Reflecting this success, SGCC entered the top 10 most valuable global brands list in the Global 500 for the first time ever in 2025, following a 20% increase in its brand value to USD85.6 billion. This milestone underscores the company’s growing influence and impact of its strategic initiatives on the global stage.

Advancements in Culture and People & Values driving China’s Soft Power

China has made advancements in the People & Values pillar, recording rank increases across several attributes. This has contributed to its overall Reputation and nation brand perceptions. For example, China has risen 27 ranks for being perceived as ‘generous’, 25 ranks for being ‘friendly,’ 15 ranks for being ‘fun,’ and 12 ranks for being ‘trustworthy.’ Meanwhile, the UK has experienced a standstill or decline in most these attributes since 2024, highlighting China’s growing persuasion in this domain.

China has also risen six ranks for being considered as a ‘great place to visit,’ and seven ranks for its ‘appealing lifestyle.’ These gains have helped China rise to seventh place in the Culture & Heritage pillar, narrowing the gap with the UK, which now holds a one-rank lead, down from three in 2024.

China’s advancements in Culture & Heritage are closely aligned with the nation’s broader Soft Power strategy, as outlined in its 14th Five-Year Plan (2021-2025), which emphasises strengthening its cultural influence and cultivating a positive national image abroad.

This strategic focus is expected to further enhance China’s Soft Power in the coming years, while the UK will need to take proactive steps to maintain its competitiveness on the global stage. Creating the UK Soft Power Council is a welcome step in bolstering Britain’s potential as a global player.

Chairman,

Brand Finance

In an increasingly interconnected and competitive world, understanding how nations are perceived has never been more critical.

As global challenges and opportunities evolve, so too does the practice of Soft Power management. Over the past five to six years, we have witnessed a profound transformation in how countries strategically approach nation branding. This shift reflects the growing recognition of the importance of Soft Power and the realisation that effective management is a cornerstone of long-term success.

At the heart of strategic leadership lies the principle of measurement. As the saying goes, "What gets measured gets managed." The Global Soft Power Index is the definitive tool for this purpose, offering a comprehensive and objective measure of how nations are perceived globally. It enables governments, businesses, and other key stakeholders to understand their standing on the world stage and identify areas of strength and opportunities for improvement.

Yet, measurement is only the first step. To navigate the complexities of the modern world, leaders must adopt a strategic approach beyond reacting to immediate challenges. This means asking fundamental questions: What do we stand for as a nation? What do our stakeholders— whether they be citizens, investors, or international partners—value most about us? And how can we craft a narrative that resonates with these audiences and equips us to weather the inevitable headwinds of global competition?

The answers to these questions are critical for managing perceptions and building a sustainable and compelling vision for the future. Soft Power is no longer a passive asset but a competitive advantage that must be nurtured actively. The stakes are higher as more countries engage in nation branding with increasing sophistication. Success requires a long-term commitment to understanding how others perceive us and aligning those perceptions with our strategic goals.

The Global Soft Power Index 2025 reflects this evolving landscape. It is both a benchmark and a guide, illuminating the path forward for nations seeking to lead and thrive globally. By harnessing its insights, leaders can take informed, decisive actions to enhance their Soft Power and ensure their country’s position in an increasingly competitive world.

I invite you to explore this year’s findings, reflect on global perception trends, and consider how your nation can strategically leverage Soft Power to build a brighter future.

]]>

Chairman and CEO,

Brand Finance

When countries and political groups increasingly wield Hard Power, a natural and common response should be for global leaders to turn to Soft Power to restore stability and cooperation.

However, we are living in uncommon times. The shifts in the current global landscape are deeper than simple conflicts across borders, and it is evident that we are experiencing fundamental, systemic challenges to traditional diplomacy. Multinational organisations are being weakened and the rules-based system established after World War II is eroding, with some countries neglecting established diplomatic frameworks, opting for unilateral approaches over collaborative efforts.

When established norms are rejected, it can make Soft Power feel powerless – after all, who has time for influence and persuasion while the rule book burns?

The truth is that uncommon times are when Soft Power has the most potential to bridge differences and build accord. Populations subject to the use of force are eager for peace and open to Soft Power as a pathway toward reconciliation. The ongoing conflict between Russia and Ukraine is a timely example: as tensions escalate and diplomatic channels are strained, Soft Power provides an escape for nations that feel hopelessly trapped in a struggle. When military might and geopolitical manoeuvring fail to reach a consensus, Soft Power is the answer, given its singular strength to de-escalate conflict and forge lasting peace agreements.

The 5th iteration of the Global Soft Power Index reveals intriguing insights into the dynamics of Soft Power in 2024. The growing significance of Business & Trade attributes amidst economic challenges and political instability underscores the role of economic strength in shaping a nation's Soft Power profile. The continued dominance of the US and UK in the Index, retaining 1st and 2nd position for the third year running, reaffirms their respective abilities to influence through a combination of familiarity, reputation, and clout.

This year, China records a rapid rise in Soft Power, overtaking Germany to claim third position, as the European powerhouse stagnates in the post-Merkel era. As large regional powers like India, Brazil, and South Africa strive to overcome challenges and realise their Soft Power potential, Middle Eastern nations emerge, rising in the ranking by leveraging strategic initiatives and major events to boost their nation brand perceptions.

As we delve deeper into the findings of the Global Soft Power Index 2024 and our new research on investment, trade, talent, and tourism attraction, we are presented with a unique opportunity to explore the potential of Soft Power in shaping a more peaceful and prosperous world.

In the face of mounting geopolitical tensions, let us not forget the transformative potential of Soft Power. The real power lies in dialogue and cooperation, rather than confrontation and coercion, to build and maintain a more stable and harmonious world for generations to come.

]]>

As our world becomes increasingly interconnected and globalised, the importance of Soft Power in international affairs cannot be overstated. The use of Soft Power has become a critical component of foreign policy for nations around the world, as they seek to build positive relationships with other countries, promote their values and interests, and achieve their strategic objectives through non-coercive means.

This is even more important when some nations use military force to impose their will on other nations.

This annual report into Soft Power covers the ability to influence others through attraction or persuasion rather than coercion. It encompasses a wide range of tools, including business and trade, governance, international relations, culture and heritage, media and communication, education and science, the character of the nation and the promotion of its values.

This year, we are also looking more closely at environmental sustainability. Soft Power enables countries to shape the perceptions and attitudes of other nations, build trust and cooperation, and advance their own interests without resorting to military force.

One of the key advantages of Soft Power is that it allows countries to achieve their goals through peaceful means. In contrast to hard power, which relies on military strength and coercion, Soft Power enables nations to win hearts and minds through dialogue, cultural exchange, and cooperation.

This can be particularly effective in building relationships with countries that may be suspicious or hostile towards one’s own nation. By demonstrating goodwill and promoting mutual interests, countries can build trust and create a more stable and peaceful international environment.

Another important aspect of Soft Power is its ability to foster economic development and prosperity. Nations can leverage Soft Power to attract foreign investment, enhance trade, promote tourism, and invite talent. All of those can help create jobs and boost economic growth in both partner countries.

However, Soft Power is not without its challenges and limitations. It requires significant investments in education, culture, and diplomacy, and may not always yield immediate results.

In addition, Soft Power initiatives may be undermined by domestic policies or actions that are perceived as hypocritical or inconsistent with the values being promoted. Moreover, Soft Power may not be sufficient to address certain challenges, such as terrorism, which may require the use of hard power.

Despite these challenges, the importance of Soft Power in international affairs cannot be ignored. In a world where power is increasingly defined by intangible factors such as reputation, influence, and values, Soft Power has become an essential tool for achieving strategic objectives and promoting international cooperation. It is up to policymakers, diplomats, and citizens alike to recognise the potential of Soft Power, and to invest in the tools needed to wield it effectively. Only by embracing Soft Power can we build a more peaceful, prosperous, and just world for ourselves and future generations.

Join us, and many of the world’s leading Soft Power experts, as we consider the opportunities and risks ahead.

]]>Queen Elizabeth the Second will be remembered as an extraordinary woman. May she rest in peace.

]]>

Brand Finance Plc has been measuring the strength and value of nation brands since 2004. In 2019, we decided to commission original research to better understand the Familiarity, Reputation, and Influence of nations and the extent to which soft power impacts these measures – the Global Soft Power Index.

Brand Finance defines soft power as “a nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics etc.) through attraction or persuasion rather than coercion”.

The third wave of our global research provides deep insight into the views of 100,000 stakeholders on 120 nation brands. This report summarises the results of fieldwork conducted in the autumn of 2021, and the opinions of various experts on aspects of soft power. The majority of these perceptions hold true today.

However, as a result of Russia’s invasion of Ukraine we anticipate significant changes to underlying stakeholder opinions of those two nations, and have commissioned a specific additional piece of research to explore this change to the three-year trend data. At the time of writing, this ancillary research is still in field and has not been included in this report. We anticipate being able to share its findings at the Global Soft Power Summit 2022.

According to Professor Joseph Nye, power is ‘’the ability to influence the behaviour of others to get the outcomes you want’’; you can coerce them with military threats (hard power); you can induce them with economic pressures (also hard power); or you can attract and co-opt them to want what you want (soft power).

The current tragic events in Ukraine sadly illustrate all three types of power. Russia seems to believe military hard power alone will achieve its objectives, but is being thwarted by heroic resistance from a much weaker military force. The rest of the world believes economic hard power will make Russia change course and withdraw, and it may eventually be right. Meanwhile, Ukraine is providing a masterclass in the use of soft power to galvanise global opinion, using conventional and social media to win the argument. Political pundits say that the only nation with the ability to stop the conflict is now China, by using its soft power leverage on Russia.

I sincerely hope that soft power does provide the solution to this global disaster. Our 21st century world needs multi-lateral co-operation, not a spiral down into the failed hard power politics experienced during most of the 19th and 20th centuries.

To show our belief in soft power, we are actively backing an initiative called Brand Solidarity. Brand Solidarity has been formed to bring brands together to express a chorus of support for the people of Ukraine and contribute to the push for peace.

Participating brands from around the globe are displaying the Brand Solidarity logo on any marketing items (from emails to websites, from advertising to packaging). All brands of any type and size are welcome to participate. For more information, please contact us or email [email protected].

I am honoured to have been invited to become a Patron of Brand Solidarity alongside Anthea Turner (TV Presenter); Brent Hoberman (Chair, Founders Forum); Sir John Hegarty (Founder and Creative Director, The Garage Soho); Simon Woodroffe (Founder, YO! Company); Sophie Devonshire (Author and CEO, The Marketing Society), and Trevor Beattie (Filmmaker), among others.

We look forward to many more brands and organisations joining Brand Solidarity, and hope that ultimately soft power will prevail.

]]>I set Brand Finance up in 1996 because I was dissatisfied with the state of brand valuation at the time. In 1996 Brand Valuation was regarded as a ‘black box’, a dark art, where brand strength and brand value conclusions were generally considered to be opaque and subjective. Particular criticism was aimed at the means of determining the level of brand equity with stakeholders, and how this could be tracked into financial performance and thence into a brand valuation result.

So, in 1996 Brand Finance set out its vision for improving brand valuation practice. This had three key elements:

1. Define the Brand in the Business

We wanted to ensure common understanding of where brands added most value. To do this, we needed to define what revenues of the business were attributable to a given brand. This is particularly important in the case of group companies with wide portfolios of brands.

We set about doing this by improving the segmentation of brand data and analysis, breaking down brands by industrial sector, geography location and customer group. We coined the term ‘Brand Due Diligence’ to describe this process and the term ‘Branded Business’ to indicate that we would include in a brand valuation only revenues sold under the subject branded entity.

Prior to Brand Finance pioneering the concept of Branded Business value it was common for brands to be valued on a standalone basis rather than in the context of the business that operated them. This meant that brands might be over or under valued because they could not be sense checked against the host branded business.

The reality is that while many directors want to know the value of the brand alone, they also want to know the value of the branded business to make strategic decisions about how to optimise value.

Brand Valuation 101

How We Value Brands in Our Annual Rankings

6 Strategic Applications for Brand Valuation

Technical Reasons to Value Your Brand

2. Incorporate Brand Stakeholders

We believe that all stakeholders respond to brands and all have preferences which ultimately lead to economic benefits for the brand. We sought to demonstrate how those perceptions directly affect behaviour and the resulting economic impacts such enhanced perceptions and preferences have.

It was clear that we needed to improve the incorporation of stakeholder research to better understand how each discreet stakeholder group perceived and acted upon subject brands. Stakeholder research should be based on quantitative market research and statistical analysis.

We called this ‘Brand Economics’ and Brand Finance was the first consultancy to refer to brand economists to analyse Brand Economics. We also coined the term ‘Brand Value Added’ to describe the ‘Brand Contribution’ made by a brand to the financial performance of each ‘Branded Business’.

Our job both then and now is to identify the extent of the uplift to the Branded Business model by the subject brand and put a capital value on that uplift. Such uplifts and capital values are now regularly used for technical, legal, commercial and strategy purposes.

3. Transparency Above All Else

We needed to improve financial transparency in terms of the financial forecasts used, and in the derivation of cost of capital. At the time, financial forecasts used by brand valuation ‘experts’ were widely considered by CFOs to be highly subjective.

As our corporate strap line (‘Bridging the Gap Between Marketing and Finance’) implies, Brand Finance has always striven to improve best practice from both Marketing and Finance disciplines. We have always sought to be transparent and to share our technical innovations with the Brand Valuation industry as a whole.

We have done this consistently throughout the last 25 years. We established the Brand Finance Institute in 2006 to share best practice via guidelines, whitepapers and training. We led the initiative to create a global standard via the International Standards Organisation in 2010, which resulted in the publication of ISO 10668, the global standard in monetary brand valuation.

We have always sought to enhance the reputation of the Brand Valuation sector as a whole, rather than defending our own narrow interest, in the belief that a rising tide of professionalism lifts all ships.

Conclusion

I believe it is fair to say that many of the leading players in the Brand Valuation industry today either worked for Brand Finance earlier in their careers or learnt about brand valuation best practice from the freely available and transparent materials we have shared over the years.

We continue to drive forward open standards. Brand Finance has been instrumental in developing ISO20671 on brand evaluation and is leading the subcommittee of ISO Technical Committee 289, which will update ISO10668 on monetary brand valuation. We will strive to continue as thought leaders and contributors in the space. We do this in collaboration with IVSC and MASB, and through our very own Brand Finance Institute.

As a company, we believe in promoting open standards and professionalism freely and transparently in brand, branded business valuations, and strategy. At the heart of our vision is bridging the gap between marketing with finance by building a common understanding of how brands work, and how they impact business performance. We will continue to enact our original vision that we set out with 25 years ago, and as the brand valuation discipline grows every year, we will continue to hone and share our understanding of this rather wonderful intangible asset we call brand.

References

- The banner photo to this article may seem oddly out of place... shoot us a note if you know the backstory!

Good CEOs are those who nurture relations with all stakeholders, and enhance the reputation of their brands as a result. Even investors increasingly care about corporate social responsibility about environmental, social and governance issues.

The role of the CEO has evolved as we navigate the era of personality CEOs where public scrutiny can be equal to that of a celebrity figure. It is no longer enough to have a vision for the business’s future. It is about forging an authentic public profile and reacting earnestly to reputational crises.

Every year, we release the ranking of the world’s top brand guardians – the Brand Guardianship Index – which includes the top 100 CEOs globally. We have researched and evaluated the brand guardianship score of over 200 CEOs this year.

For the 2021 Brand Guardianship Index, Brand Finance commissioned a survey among a panel of 288 market analysts and journalists- two stakeholder groups who have informed and influential views on chief executives’ reputation. Fieldwork was conducted in December 2020.

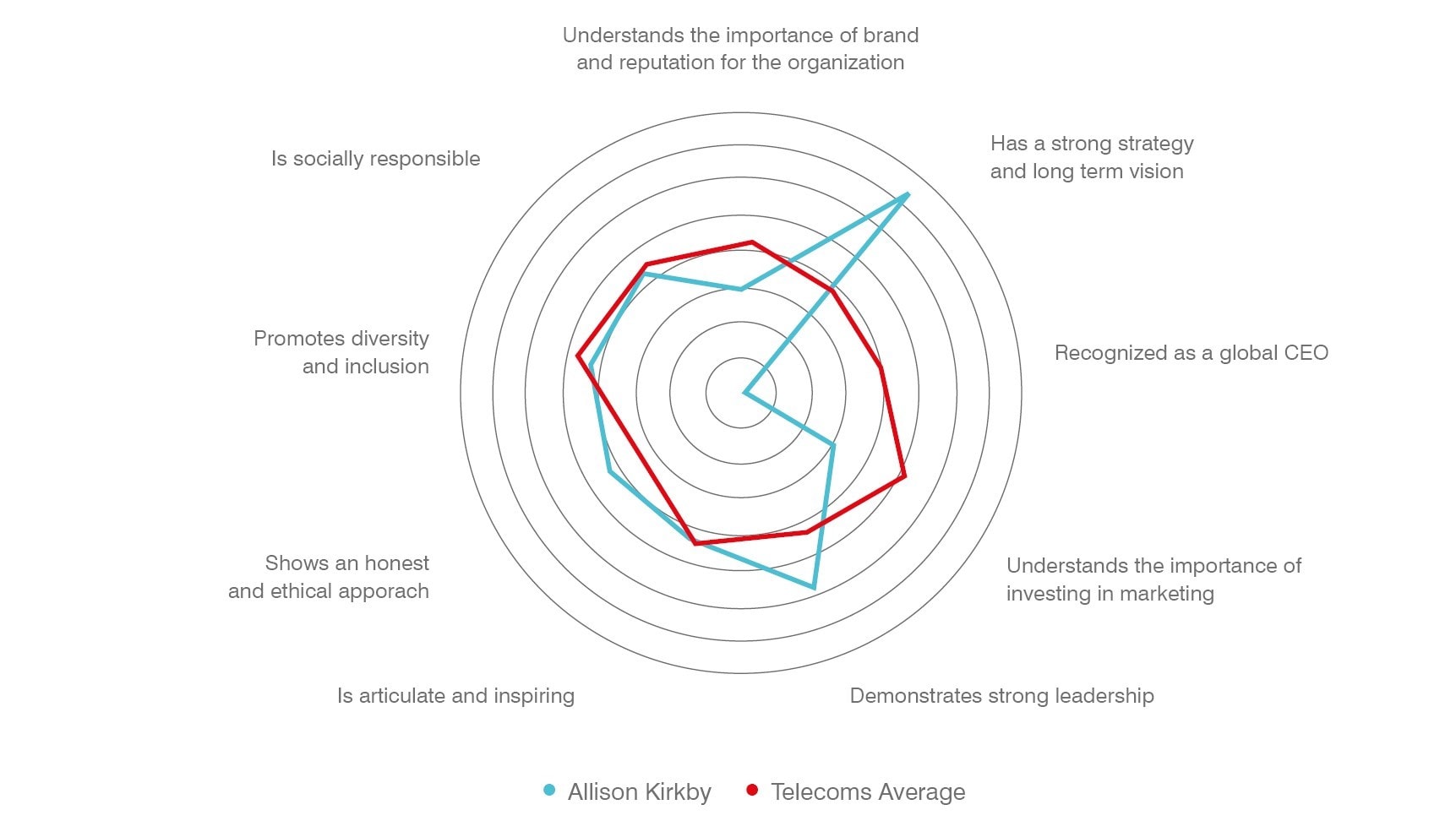

Allison Kirkby, CEO, Telia

The only female telecoms CEO featured in the ranking is Telia’s Allison Kirkby. Another newbie to the position, but by no means a rookie, Kirkby took the helm in October 2019. Previous roles include President & Group CEO of TDC Group and President & Group CEO of Tele2.

Kirkby’s visionary approach and focus on growth is clearly reflected in her third-place rank for having a strong strategy and long-term vision, with 56% of experts feeling she has a strong strategy, considerably higher than the 27% telecoms average. Kirkby is striving towards the overall vision of making Telia the leading operator in the Nordics and Baltics. As Telia puts it “connectivity has become part of the very fibre of life” and therefore the brand seeks to become resilient in a both fast paced and disruptive environment.

The combination of her powerful leadership, her engaging and inspiring manner, her visionary approach and her strong focus on growth are key reasons that she achieved a 91% approval rating among the specialist audiences polled. These high scores are reflected in Kirkby’s high employee approval ratings where she sits in the top four among the ten telecom CEOs featured.

In 2020, under Kirkby’s leadership, Telia was named Sweden’s strongest brand. The brand performed strongly across key metrics in Brand Finance’s Global Brand Equity Monitor study including price, products, consideration, familiarity, environment, governance, and reputation. With a continued focus on its CSR initiatives, the telecoms brand prides itself on its sustainable and responsible business practices, which it cites as the prerequisite for both sustainable growth and profitability.

]]>“Allison’s strong vision will be to Telia’s benefit as the Telecom industry goes through a transformational period. It will require a Brand Guardian with a clear sense of direction to navigate the challenges of Commoditisation and the 4th industrial revolution.”

David Haigh, CEO, Brand Finance