Place Branding Manager,

Brand Finance

Travel Industry Overview

The global travel industry in 2024 continues to adapt to the challenges posed by inflation and high interest rates. According to the International Air Transportation Association (IATA) there has been a convergence in key measures - Revenue Passenger Kilometre (RPK) and Available Seat Kilometre (ASK)1.

The former one measures the number of kilometres travelled by paying passengers, while the latter focuses on the total number of seat kilometres available. Convergence in these two indicators points that supply and demand are moving in tandem and airlines efficiently fill their available seat capacity. More importantly, we are witnessing an upward trend in both indicators reflecting the expanding market.

Demand for travel remains resilient in regions like Europe, the Middle East, and the Americas. In Europe, a drop in inflation to a three-year low has led to increased affordability for tourists.

The European Central Bank implementing further interest rate cuts earlier in October 2024 should further improve the overall economic outlook for the tourism sector. Some European destinations are already benefiting more than others as airlines expand their routes, increasing competition by covering more of the same destinations, which consequently leads to lower fare prices2.

The Middle East, particularly Saudi Arabia, has emerged as a tourism powerhouse, with the region surpassing pre-pandemic levels. The influx of visitors is fuelled by robust investments in the tourism sector and the region's efforts to diversify its economy. Saudi Arabia, for instance, has seen international tourist arrivals grow by 156% compared to 2019, supported by policies aimed at economic diversification3.

In the Americas, tourism has nearly fully recovered, with international arrivals reaching 99% of pre-pandemic levels by early 20244. However, inflation and rising interest rates have driven travellers to focus on domestic trips or budget-friendly options. Despite these challenges, high-income travellers continue to drive demand for luxury travel experiences, maintaining resilience in the sector.

Asia is still experiencing a slower recovery in the first quarter of 2024, with international tourism returning to 82% of pre-pandemic levels5. Yet, with inflation easing and China's full reopening, the region is expected to rebound strongly, particularly as air connectivity improves.

These regional trends underscore how economic conditions are influencing global travel patterns, with affordability and strategic government policies playing key roles in sustaining demand amidst broader economic challenges.

In order to sustain this tourism growth, it is essential for destination marketing organisations, local policymakers, travel agencies, and the industry in general to understand who their target customer is and, more importantly, how that ‘ideal traveller’ profile changes over time.

Answers to these questions can be found in the second iteration of the Brand Finance Global City Index, surveying over 15,000 respondents from 20 markets on their perceptions of the top 100 global cities. This article aims not only to provide readers with the demographic profile of the respondents but also to shed light on the key global drivers influencing the consideration to visit a particular city.

Carefully examining these drivers, alongside individual city brand results, will offer decision-makers a powerful tool for assessing whether their destination is equipped to welcome the travellers of tomorrow.

Age & Demographic Shifts in Travel Intent

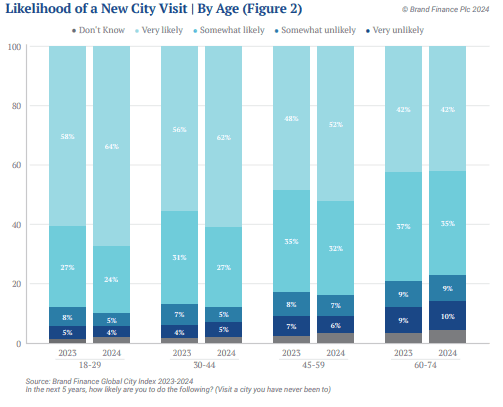

In 2024, there has been a subtle yet meaningful shift in travel intentions among respondents aged 18 to 59. The youngest group, aged 18-29, is 3% more likely to travel in the next five years compared to 2023.

Similarly, respondents aged 30-44 and 45-59 are 2% and 1% more likely, respectively. This modest increase in travel intentions suggests a renewed optimism among younger individuals, despite recent years' inflationary pressures and political volatility.

At a more granular level, we are seeing a significant increase in individuals who are 'very likely' to travel, as opposed to those who are 'somewhat likely.' This is great news for the overall tourism industry. In contrast, older respondents aged 60-74 show more stable travel patterns, reflecting either greater financial security or fewer possibilities to travel.

Education and Family Dynamics

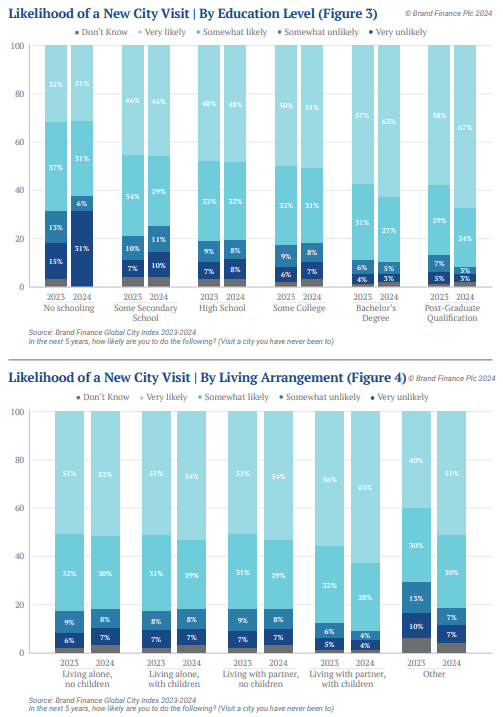

Interestingly, those with bachelor’s degrees and above show a similar optimism trend. Previously being less enthusiastic about exploring new destinations, many have shifted their stance from 'somewhat likely to visit' to 'very likely to visit'. The same caution applies to respondents living with children, who express more certainty about travelling than those living without children.

Drivers of Consideration: What Matters Most in 2024?

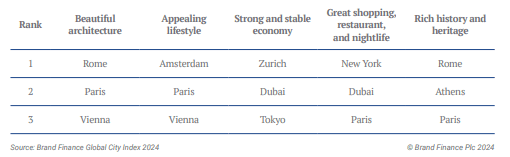

As discussed earlier, understanding the key factors that drive travel decisions is essential for destination marketing organisations, local policymakers, and travel agencies to capture a greater market share of the growing tourism sector. Applying statistical regression analysis to the findings of the Brand Finance Global City Index 2024, we have identified the key attributes influencing consideration to visit a city among all 45 city brand attributes in the study:

- Beautiful architecture

- Appealing lifestyle

- Strong and stable economy

- Great shopping, restaurants, and nightlife

- Rich history and heritage

These five attributes account for nearly 30% of the decision-making process, which has grown by six percentage points compared to last year.

Additionally, future growth potential as well as great theatres and music venues have become more influential year on year, reflecting a renewed interest in cultural and experiential travel. Consistently though, respondents are more likely to consider a city that is stable economically, reflecting the importance of perceptions around affluence and governance.

Real-World Examples of Top Performers

The top 5 city brands for consideration to visit are all European destinations:

- Rome

- London

- Paris

- Vienna

- Madrid

When we zoom-in, however, on the key driving attributes of the consideration to visit, the picture slightly changes. We can see Prague, Amsterdam, Dubai, Tokyo, Zurich, New York, and Athens among the leaders too.

- Paris: Long hailed for its beautiful architecture, it is hard not to think of the Eiffel Tower and Notre-Dame Cathedral when discussing iconic structures that have defined Paris for centuries. Additionally, perceptions of Paris are likely to benefit from the showcase offered by hosting the Olympic Games in the summer of 2024.

- Amsterdam: Known for its unique work-life balance, Amsterdam’s cycling culture, green spaces, and relaxed attitude toward leisure have cemented its status as one of the most appealing lifestyle cities globally.

- Dubai: With its strong and stable economy, Dubai’s resilience stems from its diversified sectors, including tourism, finance, real estate, trade and transport.

- New York: As an epicentre for shopping, dining, and nightlife, New York offers an unmatched vibrancy, from Times Square to the hidden gems of Greenwich Village.

- Rome: Often described as an open-air museum, Rome’s rich history and heritage make it a perennial favourite. The Colosseum and Pantheon are just two historical landmarks that fascinate travellers.

While scoring strong for one key attribute is indeed a great achievement, only a city brand that encompasses all or most of the relevant drivers can really get ahead of others. Among the five leading cities in terms of consideration to visit, Rome, Paris, and Vienna feature on the podium across several of the key driving attributes. While London and Madrid are not in the top 3 for these key metrics, they are not far behind and take high positions on others.

It is therefore worth taking a step back from your core positioning to consider the wider picture and analyse where you stand versus key competitors. This can help you determine if adjustments to your core brand strategy can be made to put you on a straight path to become a leading tourist destination.

Conclusion

As we move through 2024, the data highlights the ever-evolving nature of travel preferences, driven by macroeconomic factors and changing consumer behaviours alike. Cities that invest in understanding and adapting to these changing preferences, emphasizing their key strengths, and addressing concerns, will be better positioned to attract and retain visitors in the years ahead. The Brand Finance Global City Index provides invaluable insights to sustain and enhance their appeal in a competitive industry landscape.

Source:

1https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-market-analysis-august-2024/

2https://www.oag.com/blog/summer-2024-airfares-reduced-as-capacity-increased-on-these-european-flight-routes

3https://www.unwto.org/news/un-tourism-applauds-saudi-arabia-s-historic-milestone-of-100-million-tourist-arrivals

4https://ftnnews.com/travel-news/tours/tourisms-comeback-nearly-full-recovery-seen-in-first-quarter-of-2024/

5https://www.unwto.org/news/education-and-diversification-recognized-as-key-to-future-of-tourism-in-asia-and-the-pacific

Place Branding Manager,

Brand Finance

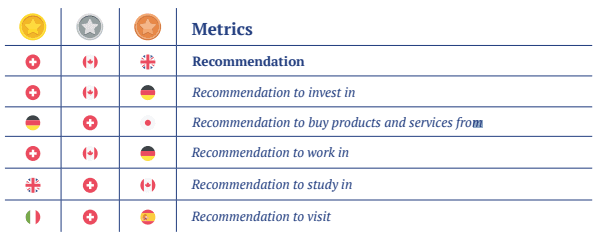

In this year’s Global Soft Power Index survey, we have included a new measurement: Recommendation, for the first time. This measurement offers a new approach to evaluating Soft Power and assesses the willingness of respondents to recommend a country as a place to ‘invest in’, ‘buy products and services from’, ‘work’ and ‘study in’, as well as ‘visit’.

Assessing the extent to which respondents recommend a country provides valuable insights into a nation brand’s potential across the crucial areas of investment, trade, talent, and tourism. Additionally, understanding variations in perceptions across target regions and markets as well as identifying the key drivers behind respondents’ recommendations is essential to developing this potential and ultimately boosting the economy.

The debut Global Soft Power Awards

Building on the findings from the new Recommendation measurement, we are thrilled to introduce the inaugural Global Soft Power Awards. These accolades celebrate nations that have excelled in each Recommendation category, shedding light on their potential to attract globally.

From analysing the survey data, we uncover valuable insights into the primary drivers behind Recommendation. Across all Recommendation dimensions, aside from the ‘Recommendation to visit’, the Business & Trade pillar is identified as the most important driver. For the tourism industry, perhaps unsurprisingly, the Culture & Heritage pillar is the most significant. Interestingly, Sustainable Future emerges as a key driver across all the dimensions too, evidencing the growing importance of engaging and communicating on environmental issues.

Switzerland has secured the title of the ‘best country to work in’ as well as the ‘best country to invest in’. Across these two metrics, being perceived to have strong Business & Trade is the most important factor for the survey’s respondents to recommend a country. Unsurprisingly, Switzerland records a stellar performance across this pillar, scoring particularly well for having a ‘strong and stable economy’, for which it gains 10/10 marks.

The United Kingdom earns the title of the ‘best country to study in’, underscoring its academic excellence and welcoming atmosphere for international students. Once again, the Business & Trade pillar is deemed most important for someone to ‘recommend a country to study in’, and the UK consistently scores among the top 10 globally across the attributes in this pillar. Perceptions across the Education & Science pillar, naturally, play a key role too. Perhaps most tellingly, the UK also comes out first globally for having a ‘strong educational system’.

Italy earns the title of the ‘best country to visit’ globally, corroborated by its rich cultural heritage, renowned cuisine, and picturesque landscapes. The only Recommendation measurement in which Culture & Heritage is the most important driver – Italy tops the leaderboard globally in that pillar. Notably, Italy is perceived as having the best food in the world.

Germany's appeal as the preferred place of origin for products and services is bolstered by its strong economy and reputation for high-quality manufacturing. Germany sits 4th in the Business & Trade pillar, scoring 10/10 marks for the ‘strong and stable economy’ metric, just like Switzerland.

Recommendation

It is noteworthy that each of the winners globally hails from Europe, highlighting the region's dominance in terms of Soft Power influence.

Regional insights

- Asia: Japan leads in most categories, apart from the ‘recommendation to visit’ metric, where the Maldives take prime position.

- Latin America & Caribbean: Brazil leads in most categories including ‘recommendation to ‘work in’, ‘invest in’, and ‘buy products and services’ from. Argentina is recognised for its appeal as a place to ‘study in’, and the Bahamas are seen as the favoured tourist destination across the region.

- Middle East & North Africa: The United Arab Emirates emerges as the most recommended country in the whole region, in all five metrics. Its perceptions across the key drivers in the Business & Trade pillar give the nation an advantage over peers – most notably, it receives 10/10 marks and top rank in the key ‘strong and stable economy’ attribute globally.

- North America: Canada surpasses the United States across all Recommendation categories.

- Oceania: Australia dominates all Recommendation categories for the region.

- Sub-Saharan Africa: South Africa stands out as the preferred destination in all categories apart from tourism, led by Madagascar.

The Soft Power Medal Table

Delving deeper into the results, Brand Finance identifies the top-performing nations in each metric across the survey as ‘medallists’, honouring them with gold, silver, and bronze medals based on their rankings. We tally the results for all underlying measures, including five key performance indicators of Awareness, Familiarity, Reputation, Influence, and Net Positive/Negative Impact, five Recommendation measures, and 35 nation brand attributes, for a total of 45 categories. We exclude the top performers across the overall Index ranking, in average Recommendation, and across the eight top-level Soft Power Pillars, which are all derived from the 45 underlying metrics, to avoid double counting the winners in our medal table.

United States is the Soft Power Olympic champion once again

The United States claims the top spot once again in this year's Soft Power Olympics, earning the title of the most decorated Soft Power country. With an impressive 11 golds and a total of 17 medals, it surpasses Switzerland (10 golds, 18 medals), and Japan (5 golds, 13 medals). The US ranks 1st for Familiarity and Influence as well as nine out of the 35 nation brand attributes, including ‘leader in science’, ‘influential in arts and entertainment’, ‘internationally admired leaders’, ‘helpful to countries in need’, and ‘supports global efforts to counter climate change’.

Norway's green commitment

Ranked 9th in the medal table, Norway shines brightly in its dedication to environmental sustainability. Leading globally in categories such as ‘acts to protect the environment’ and ranking in the top 5 for ‘invests in green energy and technologies’ and ‘supports global efforts to counter climate change’, Norway's green initiatives underscore its Soft Power influence.

Additionally, it performs commendably in the Governance pillar, being perceived as ‘politically stable and well-governed’ while upholding ‘rule of law and human rights’.

Exceptional performances beyond expectations

In a showcase of Soft Power prowess beyond the usual suspects, Egypt secures the gold for its ‘rich heritage’, while Brazil emerges as a ‘leader in sports' and earns recognition for its perception as a ‘fun’ culture. Another Latin American nation, Mexico clinches the bronze for its globally beloved cuisine, following closely behind culinary giants Italy and France.

]]>*The Halo effect is when one positive trait about something is used to make an overall judgment of that thing. The Horn effect is a type of cognitive bias that happens when an individual makes a snap judgment about something on the basis of one negative trait.

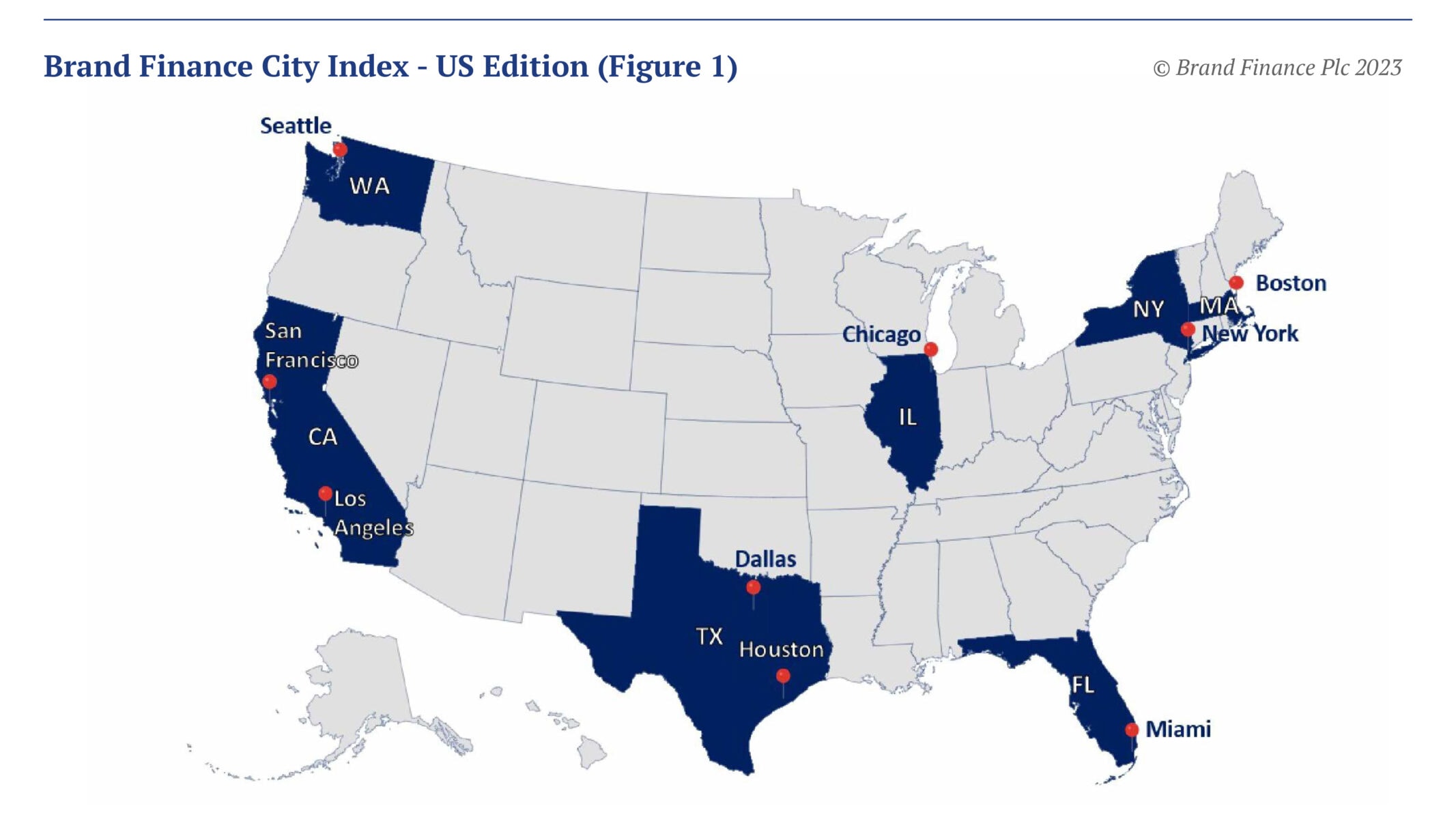

In the Brand Finance City Index 2023, nine American cities have achieved an impressive position within the top 50 best-perceived cities out of 100 global cities ranked.

The index, however, only looks at perceptions of non-domestic audiences. It is widely believed that the views of domestic respondents tend to differ from the perceptions of the outside audience. In this article, we will uncover how domestic perceptions of American cities differ from international perceptions and why matching internal and external perceptions should be one of the top priorities of city-branding strategies. Figure 1 shows the geographical distribution of the cities, ranging from the East Coast to the West Coast of the US.

The Largest and the Smallest Perception Gaps

The following cities were covered in the research: Boston, New York, Miami, Chicago, Houston, Dallas, Los Angeles, San Francisco, and Seattle.

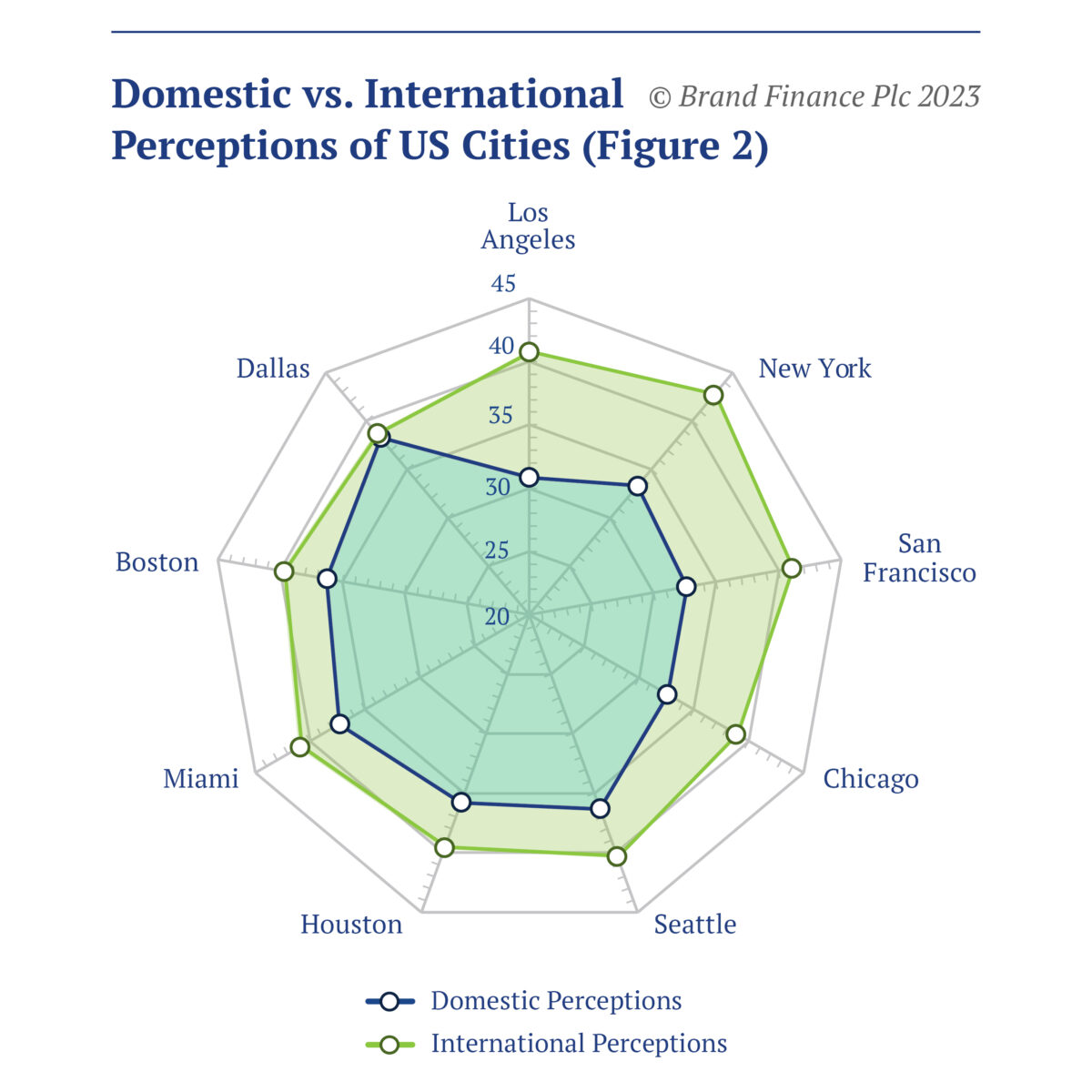

According to a weighted average of 59 attributes, the highest perception gap currently exists for Los Angeles, New York, and San Francisco (see Figure 2). International audiences see these cities as more appealing for studying, working, investing, retiring, visiting, and permanently relocating than domestic respondents.

This is great news for Los Angeles, which will be hosting the 2028 Olympic Games. By leveraging the attributes where Los Angeles outperforms, such as diverse and

multicultural (40%), great shopping, restaurants, and nightlife (39%), and appealing lifestyle (38%), global communication campaigns can be tailored to achieve a higher number of visits.

The smallest perception gap observed is in Dallas, Boston, and Miami. This outlines that the views, on average, are quite similar.

Although, after a thorough analysis, domestic audiences tend to have stronger opinions on Culture & Heritage, Livability, and People & Values.

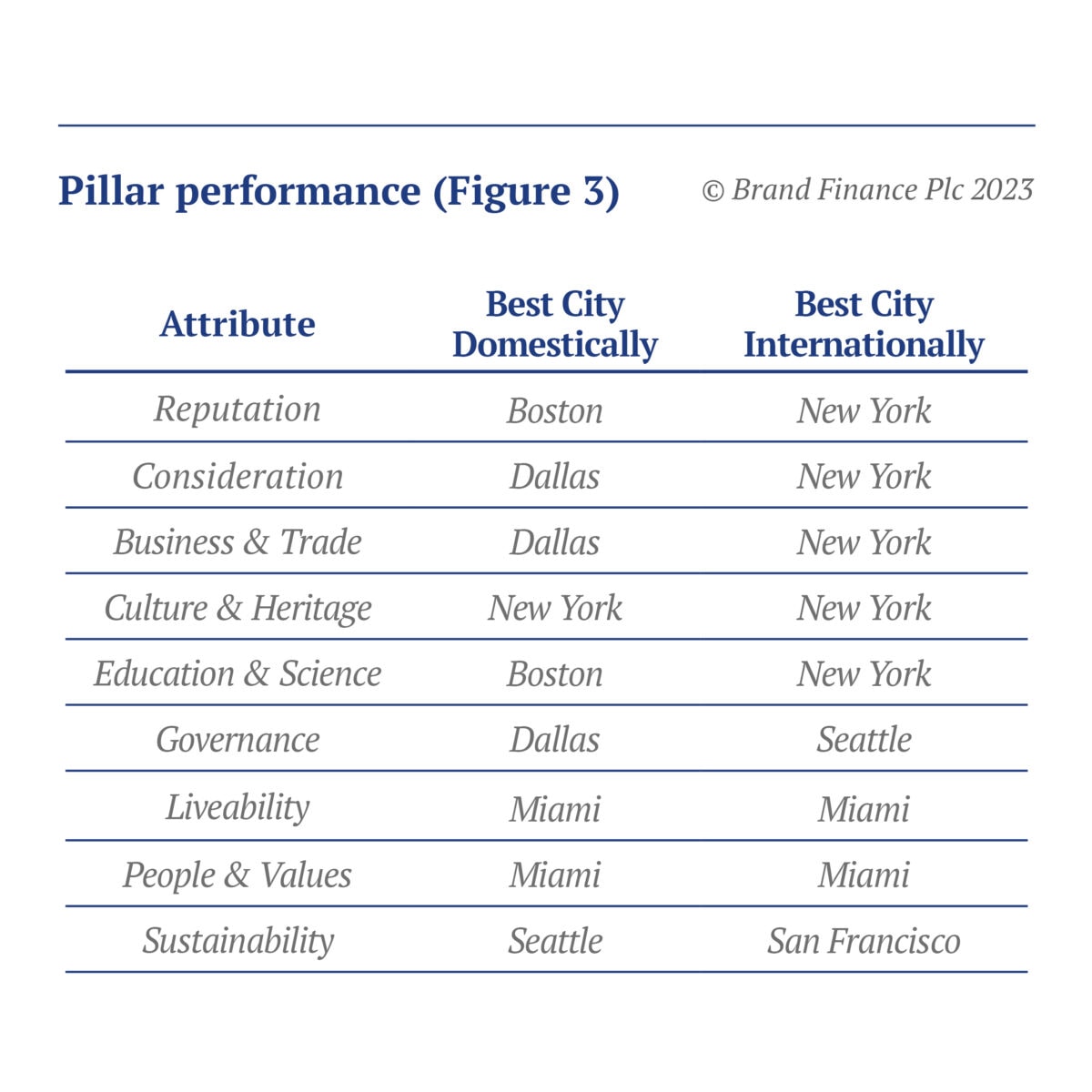

Pillar Performance

When it comes to pillar performance, New York leads among 5 pillars according to the international audience, while Dallas is the leading city across 3 pillars according to the domestic audience. San Francisco is considered the most sustainable US city, according to respondents from 20 countries, while domestically it is believed to be Seattle.

Local work

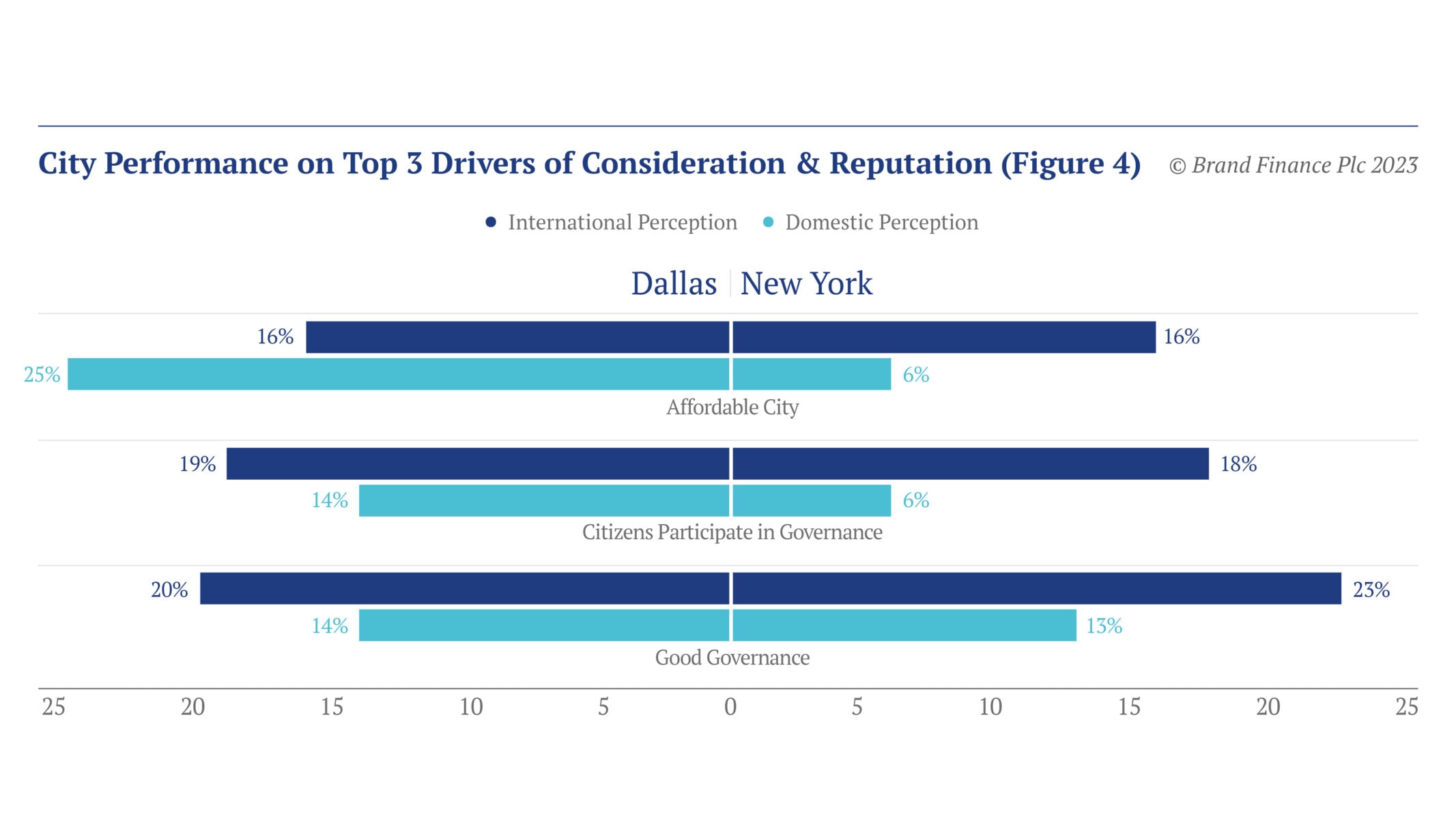

Using regression analysis to identify the drivers of consideration and reputation to work locally, US respondents perceive affordability, participation in governance, and good governance as the top 3 drivers.

When we plot (Figure 4) the performance of Dallas and New York domestically and internationally, the perception gap is tilted towards the international views.

The only significant difference is the views of affordability of Dallas according to domestic audience, which perceives Dallas as more affordable compared to the international audience. This is an important finding, as cities that strive to attract businesses and talent from abroad must ensure that perceptions of ‘outsiders’ align with the factual reality of their city. Once such issues are identified, the next step is to work on informational campaigns aimed at correcting those biases.

Conclusion

Domestic respondents are brand ambassadors of their own nations as well as the cities in which they live, study, or visit. Perception gaps, left unmanaged, create potential reputational risks for such cities abroad, and their management should be one of the top priorities among the Destination Marketing Officers.

To find out more about what attributes your city might have a significant perception gap on, request your own City Perceptions Report by emailing [email protected].