Brand Finance recently hosted the Brand Exchange Event: Banking 500 CMO Roundtable in the wake of the Brand Finance Banking 500 2025 report release. The report aims to provide leaders of banks with insights to successfully navigate a volatile operating environment with evolving customer expectations. The event and the roundtable offered insights into global banking trends, with a particular focus on the challenges senior marketing leaders face. The Brand Exchange aims to connect senior marketing and brand leaders to meet peers and share stories.

A central theme identified in the report, and reinforced by industry leaders during the roundtable, was the increasing importance of trust and strong branding within the banking industry. In an environment shaped by geopolitical uncertainty, rapid technological innovation, and shifting consumer expectations, trust is paramount. Challenger/ neobank brands made gains this year, with Revolut the fastest growing brand worldwide at +795% year on year. We asked the banking marketing experts how they plan to balance what seem like conflicting needs of innovation and trust.

Experts feel that both are within reach, but this relies on a strategic shift needed from product-centric approaches towards customer-centric models to strengthen confidence and loyalty. While challenger banks are driven by convenience and customer experience, incumbent banks must gear up their technological capabilities to analyse and leverage their significant databanks of consumer spending to enable greater customer-centricity and hyperpersonalisation of offers. For example, leveraging data to promote products to customers based on their life stage and key events such as a child starting university. Fundamentally, experts emphasised that banks need to think about customer convenience, starting with “brilliant basics” before chasing more exciting advanced innovations.

The marketing leaders also emphasised the importance of shifting focus from short-term goals such as new account switches, to long-term goals such as building trust. They talked about their experience of making a case for brand building over shorter term performance marketing. The techniques and tools the experts swear by are textbook change management - when developing a new campaign or positioning, bring other executives along on the journey with you to foster a sense of ownership and acceptance from the start.

We hope the Banking 500 journal proves useful to senior marketing leaders around the world in quantifying the long-term value they generate, and welcome conversations about how we can support bridging the gap between marketing and finance within your organisations.

The Brand Exchange Event: Banking 500 CMO Roundtable was held in London on Thursday 3rd April, 2025. If you are interested in joining future industry leader roundtables, please email [email protected]

Read the full Brand Finance Banking 500 2025 report online here.

Valuation Director,

Brand Finance

As Brand Finance continues to promote the importance of intangible asset value, we are working in tandem with organisations including the Institute of Practitioners in Advertising, (IPA) International Valuation Standards Council (IVSC) and World Intellectual Property Organisation (WIPO) to promote better monitoring and understanding of intangible assets. For example, intangible asset intensity of nations as measured by the Brand Finance GIFT™ study has been included as an indicator of innovation productivity within the UN-backed WIPO Global Innovation Index.1,2

The silent challenge

Previous GIFT™ reports and consultation by Brand Finance have outlined the limitations of accounting and reporting standards, and the resulting challenge of low disclosure in intangible assets. Financial statements need to be fit for purpose and useable by investors, lenders and others to mitigate risk and allocate capital efficiently to maximise their return on investment.

Our 2024 study estimates that 79% of global intangible asset value is not disclosed in balance sheets. This is due to the historic limitations set by the accounting standards boards which state that internally generated intangible assets, such as brands, cannot be disclosed in a company balance sheet.

The resulting void between disclosed financial statements and the reality of company value is so large that balance sheets are increasingly redundant for those evaluating the performance of the biggest, most innovative, and most valuable companies in the world.

Regulatory progress

IASB adopted IAS 38, the landmark accounting standard on intangible assets, in April 2001. Since then, total global intangible asset value has grown from $20trn to $79trn, but IAS 38 has not been substantially revised. However, that may no longer be the case.

To the great excitement and anticipation of intangible asset specialists, IASB added an intangible assets project onto their research agenda in December 20203. They’ve released their summary4, and their next steps are surveys of stakeholders, including a separate survey of users of financial statements. The updated summary inclusive of this research will be presented at a future IASB meeting – date TBD – followed by an IASB analysis of that feedback and evidence. Finally, the Board will present recommendations on the project objective, scope, and a tentative plan.

A review of IAS 38 is likely complex due to the materiality of intangible assets, and because the project is interrelated with other ongoing standard revisions and developments, particularly in the areas of management commentary and sustainability disclosure. Given this expected complexity, the project scope could be limited to updating IAS 38 within its current paradigm of focus on acquired intangible assets.

However, the IASB appears open minded. It is possible that the scope of the research project could extend to cover investments into internally generated intangible assets. This would mean that a company could disclose the value of its own brand which it has built, as well as any brands it buys as part of any M&A activity.

The implication is that expenditure on brand marketing could be considered capital expenditure, rather than operating costs, a huge benefit for firms seeking an incentive to invest in long-term brand building, or to marketing teams seeking internal understanding and approval of long-term investments.

The project covers a broad spectrum of intangible assets, including software and R&D, and should the project scope extend to cover intangible assets held for investing, it would include cryptocurrency. The result would be an evolved balance sheet that is a relevant source of information for investors.

Intellectual property momentum

In addition to this landmark review, there is evidence from intellectual property office agendas that we’re moving toward a better understanding of intangible asset value.

Intellectual property offices are actively working with stakeholders such as valuers, standard-setters, auditors and tax authorities to identify routes to unlock value and access to finance for intellectual property-rich entities.

Banks including RBC, JP Morgan, NatWest and HSBC now offer loans using intellectual property as security, a particularly attractive option for startups and scaleups seeking finance to leverage their unique intangibles.

Actions to take now

Given intangible assets are on the agenda of standard setters, intellectual property offices and financiers, it’s clear that CFOs should ensure they are prepared to take advantage of the changes on the horizon. CMOs are also stakeholders, as guardians of brands, one of the most stable and significant intangible asset classes.

For both CFOs and CMOs, we recommend the following actions, to prepare for future evolutions in intangible asset reporting requirements, and to leverage the benefits of intangible asset management:

- Identify the key intangibles of the entire business, both internally generated and acquired.

- Seek expert advice on the value of those intangibles, and consider sharing this in the notes to your financial statements.

- Monitor the businesses’ various intangible assets and what drives their value.

- Take action to optimise those drivers, build long term intangible asset value, and enhance overall business performance.

Brand Finance continues to support its clients in bridging the gap between marketing and finance and we look forward to assisting others seeking to maximise and leverage the value of their brands.

]]>

Valuation Director,

Brand Finance

The unofficial competition between apparel brands to win the hearts of Olympic fans with their team designs is almost as fierce as the competition between the athletes themselves. With the return on investment into brand sponsorships and partnerships at stake, the field has gotten more crowded, with smaller brands such as Lululemon, Asics, and Le Coq Sportif joining heavyweights Nike and Adidas in the battle for share of voice and association with the games.

When it comes to impactful brand sponsorships and partnerships, the winners and losers are determined by subject matter relevance and memorability.

The 2024 Paris Olympics served up a host of memorable moments for apparel sponsors and partners, and high fashion and independent designers seized opportunities to spotlight their creativity. As larger and more diverse mix of apparel brands buy in, it becomes increasingly challenging for individual brands to stand out.

THE ELUSIVE VIRAL MOMENT

Whether Olympics fans were dazzled by the show or disappointed by the drizzle, the opening ceremony and preluding photoshoots were a feast for the eyes thanks to creative team outfits. Local designer Michel & Amazonka designed and manufactured the kits for team Mongolia, grabbing headlines with a design inspired by the Mongolian Naadam Festival that seamlessly blended modern and traditional elements.

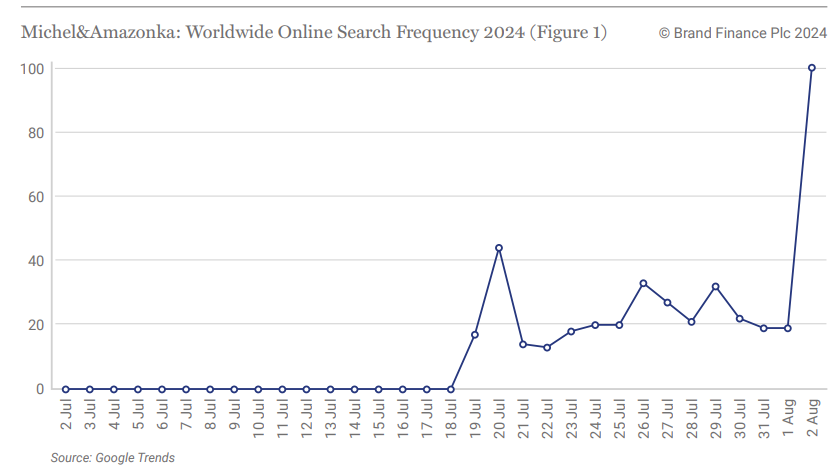

Although it was Michel & Amazonka’s third Olympics as the official designer of Team Mongolia, the Paris 2024 Summer Olympics games demonstrated that when brands produce the right mix of creativity and virality the international exposure of a platform like the Olympics can be an incredibly effective marketing tactic for rapid exposure. Michel & Amazonka experienced a surge in interest following the official image release and during the opening ceremony (Figure 1).

But for all its pomp and ceremony, the first night’s festivities are less likely to be the main commercial opportunity for global apparel brands. Instead, relevant supporting campaigns and team kit or product placement partnerships tend to yield a longer-term commercial gain, as evidenced by the running battle between Nike and Adidas to dominate the Olympics in terms of building their brands.

AN ONGOING ATHLETIC RIVALRY

In the Beijing 2008 Olympics, the combined opportunity for global brand building and host market growth led to an aggressive marketing battle between Adidas and Nike.

While Adidas was an official sponsor and launched a large “Impossible is Nothing” local campaign, Nike secured team China sponsorships in 22 of 28 sports. Targeting local fans, both brands invested significantly, Adidas was estimated to have spent $190m and Nike was estimated have invested $150m in sponsorship and associated marketing.

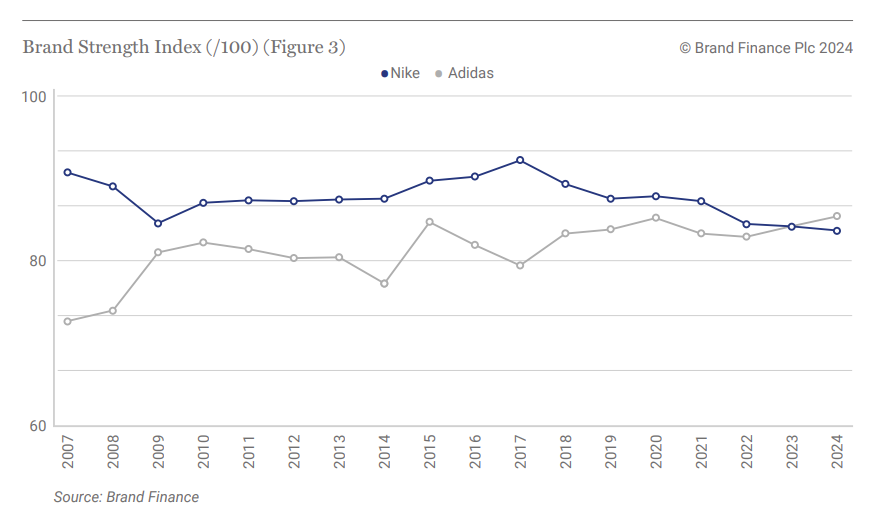

Brand Finance analysis suggests that Adidas was the overall winner, gaining an impressive 7 points in global brand strength (Figure 2), bringing it closer to the levels of Nike and marking the beginning of a turnaround which saw the Adidas brand value rise from $5bn in 2007 to a staggering $15bn this year.

Adidas entered an exclusive title sponsorship for The London 2012 Summer Olympics, as Nike infamously counteracted with guerrilla tactics.

The Adidas agreement prevented Nike from officially referencing the Olympic and London 2012, but Nike creatively swerved the restrictions by onboarding 400 athletes as ambassadors to compete in Nike shoes.

Nike also filmed their “find your greatness” campaign in creative locations like London, Ohio and Little London in Jamaica, and by continually focusing on individual athletes, closely competed with Adidas’s title sponsorship for brand visibility and impact.

Research during the games found that more consumers thought Nike was an official sponsor than Adidas. Had it not been for Nike’s campaign, Adidas would likely have seen significant gains following London 2012, but ultimately, the overall brand strength impact on both brands was minimal.

Rio 2016 was the Nike heyday. An online linguistics monitoring tool, GLM, recognised Nike as the top performing non-official sponsor brand in terms of association with the games. Nike’s brand strength hiked to its highest observed level ever since Brand Finance began tracking the brand in 2007 (Figure 3).

With a brand strength of 92/100 it was the 3rd strongest brand in the world in 2017, following the success of its various athlete endorsements and marketing activities throughout Rio 2016.

Both brands pulled back for the Tokyo 2020 Summer Olympics, held in 2021 due to the pandemic. Nike reportedly invested $39m in advertising, a quarter of what it spent for Beijing in 2008. This lower investment, coupled with general overshadowing of the games by COVID-19 led to a net loss in brand strength for both brands as Japanese Asics saw a positive impact with its gold partner status and role in supplying uniforms for team Japan as well as volunteers at the games.

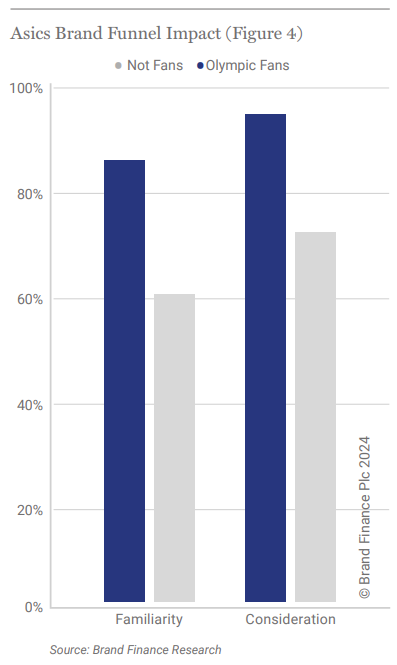

The lasting impact is evidenced in our latest brand research which found both familiarity and consideration for Asics to be significantly higher among fans of the Olympics than non-fans (Figure 4). Asics is likely to further cement its Olympics-generated brand building success following its recent agreement to be the first ever official supplier to the International Paralympic Committee.

LOCAL BRANDS, GLOBAL ARENA

Country of origin and soft power are undoubtedly a factor in emotional connection, relevance and effectiveness of sponsorship activities for apparel brands.

Lululemon appears to have hit the bullseye for relevance, memorability and impact with stylish designs and relevance given the brand’s premium activewear capability coupled with its Canadian origin. Since the opening ceremony, the brand has seen a 13% global rise in search frequency according to Google Trends.

The partnership is not without criticism due to greenwashing accusations particularly domestically and in France, but Brand Finance experts expect the overall global impact to be positive in terms of recognition and consideration for the brand in the coming year. In the latest study, Brand Finance estimated the Lululemon brand to be worth $6bn, with almost 10% growth since last year following the appointment of ex-Nike exec Nikki Neuberger as chief brand officer.

French apparel brands have come out in force for the Paris 2024 games. Louis Vuitton is likely to experience positive impact on brand value next year on the back of its “The Mission” campaign featuring iconic branded leather suitcases. A clip of this campaign was shown in the opening ceremony and the brand provided medal cases for the games.

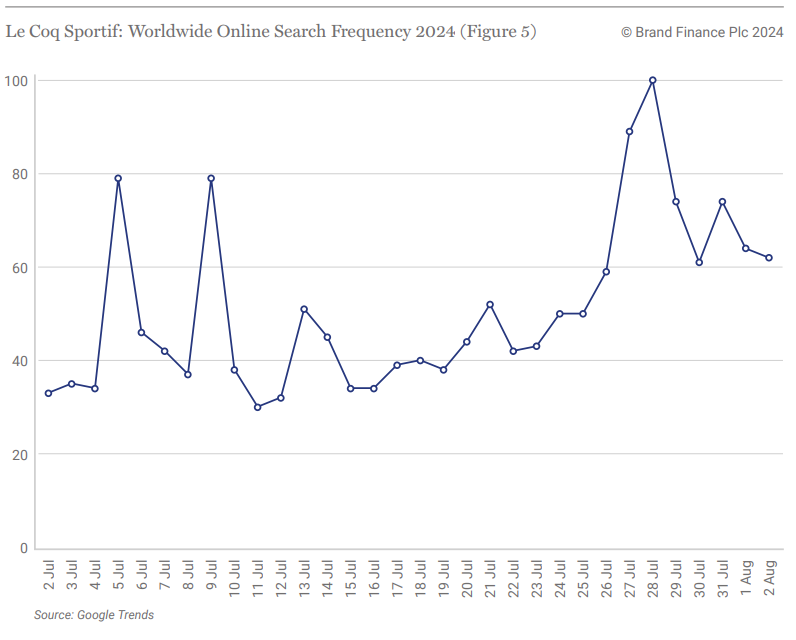

Compatriot Le Coq Sportif saw a notable 60% rise in google search rate following the opening ceremony (Figure 5). The traffic increase was mostly in France, where domestic origin brands typically perform well on preference versus international counterparts.

Nike is reportedly countering the competition with its highest investment in Olympics marketing to date, and a somewhat controversial campaign emphasizing individual pursuit of greatness in its “Winning: not for everyone” campaign. As shown in figure 3, Adidas overtook Nike in brand strength for the first time last year following success in top football team sponsorships and a resurged interest in its casual footwear such as Sambas.

However, Adidas’s Paris 2024 impact has been scuppered by the controversy surrounding its campaign featuring Bella Hadid, which has been criticized as antisemitic.

The campaign controversy for Adidas, coupled with Nike’s apparent Olympics push and renewed public interest in the brand’s ambush campaigns of 2012, might well lead to another year of roaring success for Nike. However, following a drop in brand value by 5% since last year, if the brand is going to reclaim its winning rank, Nike does need to just do it.

1 https://www.theguardian.com/sport/2008/aug/18/olympics2008.retail

2 https://www.campaignlive.co.uk/article/marketing-olympics-sponsors-leading-race-london-2012/1139142; https://www.kantar.com/inspiration/brands/paris-2024-offers-brands-an-olympic-sized-opportunity

3 https://www.insidethegames.biz/articles/1041052/exclusive-study-claims-nike-achieved-best-ambush-marketing-campaign-at-rio-2016

4 https://digiday.com/marketing/nike-eyes-marketing-moment-at-the-olympics-as-industry-execs-sound-off-on-the-brands-challenges/

5 https://www.globallegalpost.com/news/canada-olympic-kit-sponsor-lululemon-faces-greenwashing-action-in-france-1587667102

6 https://digiday.com/marketing/nike-eyes-marketing-moment-at-the-olympics-as-industry-execs-sound-off-on-the-brands-challenges/

7 https://www.ft.com/content/f5d620a5-6da0-4a5c-ab58-6deaf6b97a06

London is crowned the best city brand in the world by the Brand Finance City Index 2023, thanks to its history, culture, and housing of major global brands.

At the same time, the City of London – the core financial district in the Greater London metropolis – is The City within the city. The City of London was initially established in Roman times, subsequently re-established later in the first millennium, and today is governed separately from Greater London, led by the locally elected Lord Mayor. The City of London is also home to Brand Finance headquarters at 3 Birchin Lane.

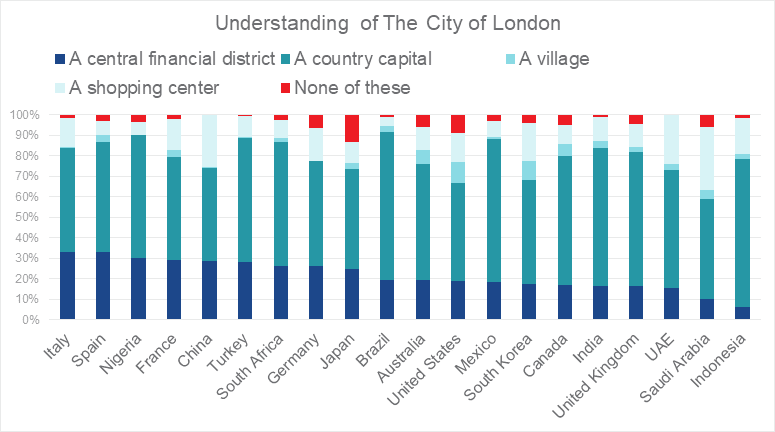

The Brand Finance City Index 2023 is informed by an original piece of general public research conducted by Brand Finance. In this research, we have measured sentiment towards major cities around the world, as places to work, live, study and visit. In addition, we asked all the respondents who are familiar with London what they think of when they think of “The City of London”. The vast majority get it wrong, assuming that the question is simply referring to London.

One of countries with the lowest familiarity with The City of London is the United Kingdom itself, with only 16% of the British public knowing what The City is. The best understanding of The City is seen in Italy and Spain: perhaps Italians are sympathetic with the nuance given the similarity between The City and Vatican City. Broadly, however, many people are unaware of the difference between Greater London and The City of London.

It’s time to recognise that while London as a whole has strong appeal, The City of London is not nearly as famous and therefore influential as insiders may think. This brand challenge is more concerning when we consider the significant value generated in, and traded through, The City of London. Like The City of London itself, most of the value generated within the square mile is not held in tangible assets, nor is it reported on. This leads to the natural concern about management and longevity of these assets.

Brand Finance recently had the pleasure to partner with Sheriff Andrew Marsden of the Corporation of The City of London, to research and discuss intangible asset value and The City with leaders of institutions and Livery companies in The City.

Click here to read more about Intangible Asset value online here

Every year, through our GIFT™ report, we estimate intangible value globally, based on capital markets. In the latest report, October 2022, we found that globally, intangible assets are worth $57.3 trillion. 70% of this value is estimated as the trading premium of companies versus their net book value. This means that the majority of this value is not recorded or reported in company accounts.

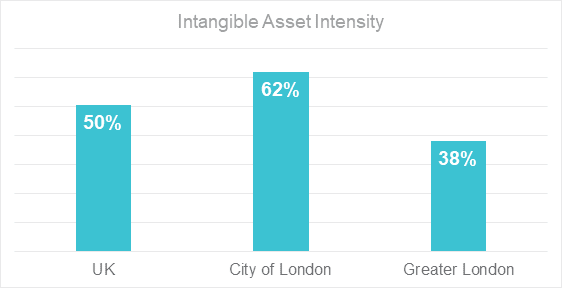

Updated analysis conducted last month found that over half of the UK’s intangible asset value is generated in London, with almost 1/3 of that generated within The City of London. While Greater London is approximately 40% intangible, The City of London is far more intangible, with 60% of total value estimated to be intangible assets rather than tangible.

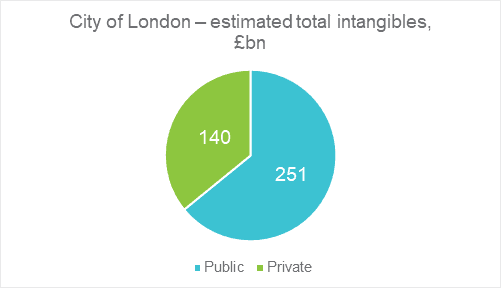

We extrapolated our analysis to estimate the intangible value of private companies too, based on headcount in The City. This analysis suggests that The City of London is home to an incredible £400 billion of intangible value.

Due to limited reporting of private companies and legacy accounting practices, only 12% of this value is publicly reported. In addition to the £400 billion housed in companies in The City, significantly more value is generated and traded through The City. And significantly more may be generated by The City Corporation itself. We regularly question whether such a low incidence of reporting leads to the likely conclusion that very little intangible assets get the attention, management, and investment they need. We continue to advocate for better disclosure of, management of, and investment in intangibles. The same advice is echoed by academics, industry practitioners, and expert institutions here in The City and around the World.

This new research is further evidence of the importance of maintaining brand strength, provides new insights from our latest analysis of a range of studies, and underlines the critical role brands play in the economy. The report considers how brands perform

in times of crisis and in recovery; how brands deliver stability and reduce risk; how brands restart economies and build consumer confidence; how brands improve national competitiveness and above all, how strong brands outperform their competitors to earn more money for brand owners.

We also look at some of the building blocks of strong brands and outline the role that familiarity and consideration play in developing that strength and how these factors can help to explain and predict market share.

We hope this research provides both inspiration and practical benefit to marketers and their agencies as they move forward to a post pandemic era.

]]>The proposed acquisition makes sense for Estée Lauder given it already works closely with Tom Ford via its brand license for the Tom Ford Beauty line. Our latest study suggests that the Brand Value of Tom Ford Beauty alone is approximately $1bn, driven by growth outlook and brand awareness. In its third-quarter earnings call three months ago, Estée Lauder said that Tom Ford Beauty was one of a few brands with double-digit sales growth. Tom Ford is a well-established brand, achieving 62% awareness among US consumers in our latest global survey. The brand value of Tom Ford as a whole is not known, but could be worth in the region of $2bn.

Historically, Estée Lauder has focused on cosmetics and wellness brand acquisitions. During the pandemic, home-working and reduced socialisation led to a dip in colour cosmetics, and an upsurge in wellness products. Continuing supply chain disruptions and rising material costs are posing a threat to cosmetics players like Estée Lauder. Analysts claim that this move to acquire Tom Ford signals a potential wider venture to become a diversified luxury house like LVMH. Unlike LVMH, which has a well-known record of acquiring and transforming various small and large luxury players from all over the world, Estée Lauder’s record is more conservative and focused on the US. 2/3 of Estée Lauder acquisitions in the past 30 years were purchases of US companies, versus 1/5 for LVMH.

A notable past US acquisition by Estée Lauder was its acquisition of Jo Malone in 1999. Similarly to Tom Ford, the brand is eponymous. Jo Malone remained as Creative Director of the brand under Estée Lauder’s ownership until 2006 when she left. Her exit deal meant that she lost control of her brand, her own name. Her regret over this decision is well-documented and in 2011, she launched a new perfume brand, Jo Loves. Although details are not yet confirmed, it is likely Estée Lauder will adopt a similar strategy for the integration of Tom Ford and therefore the ex-Gucci designer is likely to remain onboard for the foreseeable future.

]]>The majority of intangible assets are not recognised due to the limitations set by the accounting standards boards such as the IASB and the US FASB which state that internally generated intangible assets such as brands cannot be disclosed in a company balance sheet. This is why Brand Finance endeavours to estimate the extent of this “undisclosed intangible value” in our GIFT™ study each year.

Regular readers of the Brand Finance GIFT™ report will be familiar with Brand Finance’s position on the current state of intangible asset reporting. We also spoke to other experts in the field and are pleased to share their views within this report1

Call to Action

Under both IFRS and US GAAP, companies are not permitted to disclose most of their internally generated intangibles on the balance sheet. This leads to an oddity where acquired intangibles are measured and included in the books if they were gained through an acquisition, but the often more valuable internally generated intangible assets are unavailable. This is one factor that leads users of financial statements to disregard intangible asset values in financial statements – they are immaterial and don’t say much about the overall organisation’s intangible value. This oddity can also lead to mismanagement and poor decision making.

"Unfortunately, the ban on assets appearing in balance sheets unless there has been a separate purchase for the asset in question, or a fair value allocation of an acquisition purchase price, means that many highly valuable intangible assets never appear on balance sheets. This seems bizarre to most ordinary, non-accounting managers. They point to the fact that while Smirnoff appears in Diageo’s balance sheet, Baileys does not. They point to the fact that the Cadbury’s brand was not apparent in the balance sheet or reflected in the share price prior to Kraft’s unsolicited and ultimately successful contested takeover of that once great British company. Too many great UK brands have been bought and transferred offshore as a result of this ongoing reporting problem.”

David Haigh, Chairman & CEO of Brand Finance

Brand Finance has long-supported better disclosure of internally generated intangibles. We think that management should undergo an exercise each year to identify and value its key intangible assets. The immediate benefit would be better management, under the old adage of “what gets measured gets managed”.

If management were to take it a step further and disclose their opinion of their intangibles in the notes of their annual report, this would provide greater transparency and reduce the information asymmetry between the market and management.

As with any other element of financial reporting, this information would help to better equip investors with information to guide their capital allocation, so they can efficiently maximise their wealth. In a world where the role of technology, reputation, and customer loyalty is increasing, the time is nigh for a radical shift to improve the quality and relevance of intangible asset reporting.

The Dystopia of Disclosure

Corporates face both legal and financial challenges to full disclosure of all material assets.

“I recognise the utopia where you could have the value of the balance sheet equate to the enterprise value, but I don’t think it is likely.”

David Matthews, President of the ICAEW

One of the main challenges, particularly faced in the UK, is in the restrictive nature of Corporate Governance principles.

“The US is clearly a far more litigious environment, and management teams are in danger of far more draconian civil and criminal enforcement in the US, and yet US management teams are overwhelmingly more focused on taking more risk, because that environment is more permissive to taking risk. And in taking risks, they’re also making greater disclosure. But I think in the US it’s a much more rules-based regime, whereas in the UK, the guidance and the onus is on you to make your decisions, and [the regulator] will decide whether or not to hold you up on those decisions, but [the regulator] isn’t necessarily going to tell you the basis of that decision. And I think that has a strong influence on how management teams feel about the environment, and their subsequent appetite to disclose intangibles.”

Mark Wilson, Former CFO of Aston Martin

The other challenge lies in concerns about the volatility of intangible asset valuation. However, this volatility would bring the nature of financial reporting closer to reality. Share prices are inherently volatile, and therefore it follows that the fair value of assets could and should be sensitive to changes in information.

A further criticism is a question of the consistency and quality of valuations of internally generated intangibles. The concerns are not surprising, taking into account the track record of intangible asset reporting so far, for acquired intangibles.

“When IFRS 13 came in, I was really hopeful that the quality of valuations in financial reporting would dramatically improve and I have been really disappointed because it hasn’t; everybody has looked for ways to group their assumptions, put in weighted averages, pool assumptions from things that are very different and so in the end the reader has no idea what assumptions were made in the valuation process”

Shan Kennedy, Independent IFRS and Valuation Expert and former project director at the UK Accounting Standards Board

For these specific intangible assets that are disclosed, they are generally not relied upon by investors. This is not helped by the little accompanying disclosures of assumptions and methodologies used. In addition, the majority of disclosed intangible value resides in goodwill.

Goodwill itself should only represent the synergies between various assets and between the entities involved in the business combination. All other aspects of goodwill, such as reputation and customer loyalty belong to specific intangible asset classes. But in practice, these specific intangible assets can be undervalued, and goodwill therefore overvalued.

“Practice doesn’t represent what the standard says because goodwill is just smeared into a grey area; it’s too easy for corporates to throw it into the goodwill pot and never do anything with it because they’re not forced to. […] The key is pushing people into greater disclosure and forcing boards into a more critical view where today they don’t need to.”

Mark Wilson, Former CFO of Aston Martin

As discussed at length in "What Went Wrong With Carillion? The Accounting Treatment of Goodwill", a further issue with goodwill is that companies do not impair it as frequently or as significantly as market conditions suggest they should.

In the two years leading up to Carillion’s collapse, the reported level of goodwill exceeded the total enterprise value of the company. Since 2011, goodwill represented at least 84% of total business value. However, during this time, Carillion did not impair its goodwill, allowing retained earnings to remain stronger, and thus facilitating pay-outs such as executive compensation.

Goodwill Impairment in Practice

Carillion is not alone; analysis conducted earlier this year found that only 10% of entities with goodwill reported took an impairment against goodwill in 2019. And among the handful of entities where goodwill has represented more than the total value of the company for 2 years running, only 27% of those companies took a goodwill impairment in 2019.

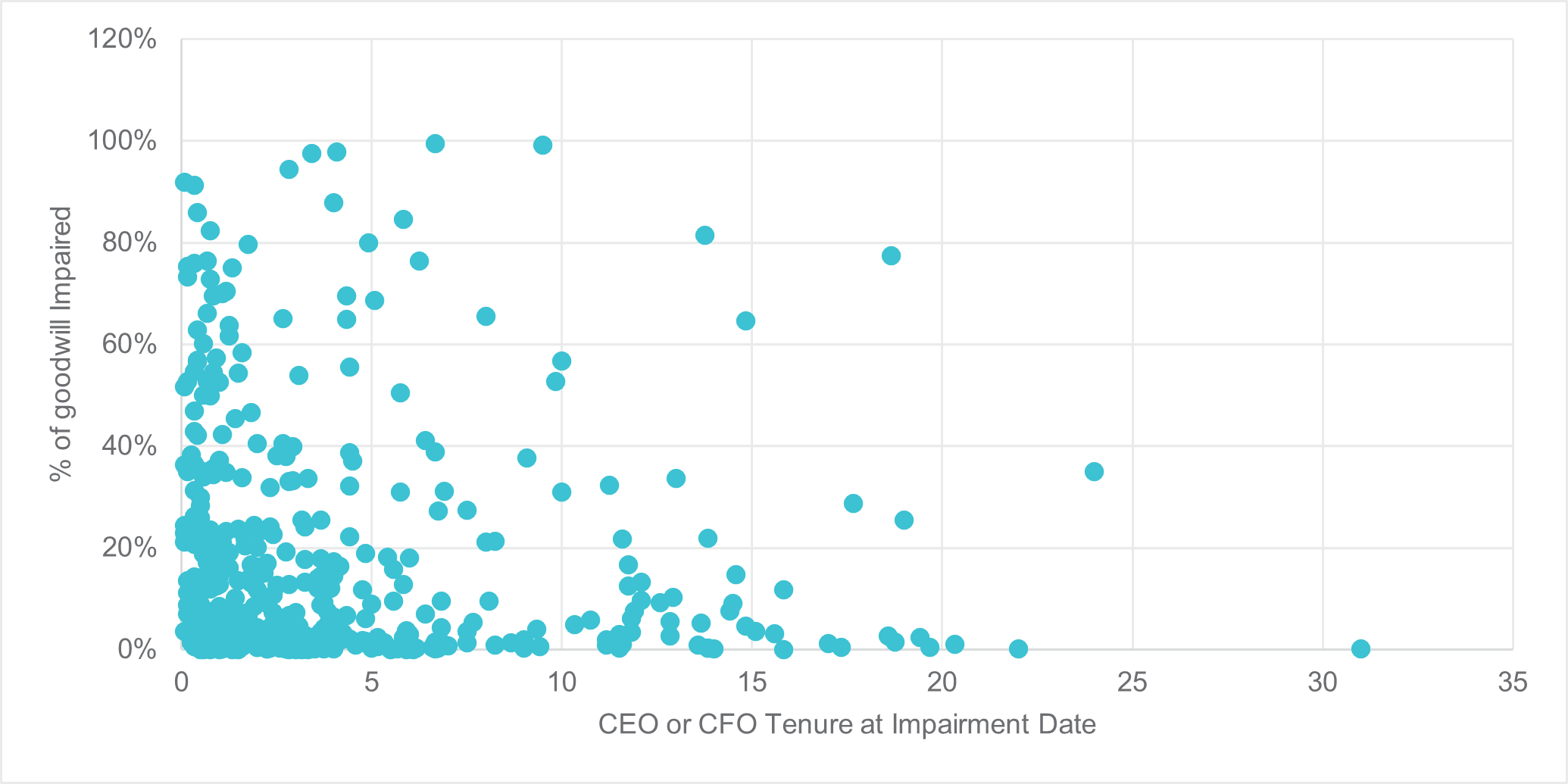

You may feel that while impairment may be an infrequent occurrence, these impairments - where the carrying amount of goodwill exceeds total company value -should be larger, but our analysis suggests that the size of an impairment cannot be predicted by how large a company’s carrying value of goodwill.

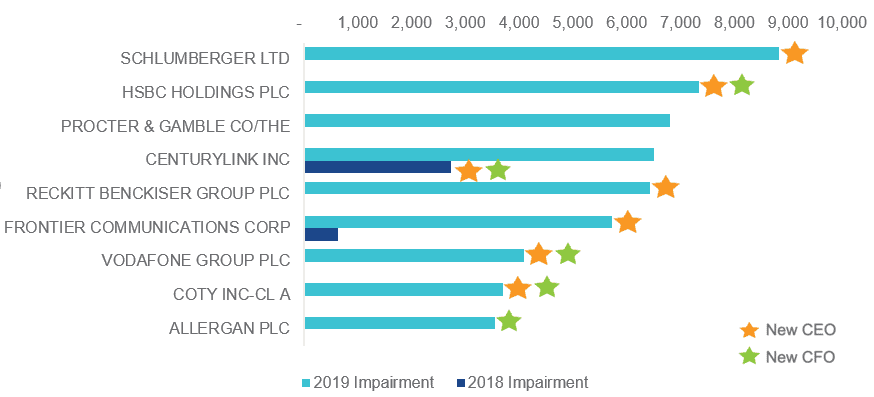

One thing that 2019’s largest impairments do seem to have in common is new leadership. 2019’s largest impairments are summarised in chart 9.

Except for Procter & Gamble and CenturyLink, all companies listed had either a new CEO, a new CFO or both in 2019. The majority of these companies’ previous leaders decided to not take an impairment in 2018. CenturyLink did take an impairment in 2018, when it also had both a new CEO and CFO.

Therefore, new leadership appears to have a significant impact on the likelihood a company will impair its goodwill. Among the entire sample, we found that 30% of all impairments occur within the first year of having a new CEO or CFO.

For larger impairments, where the impairment represents at least half of the goodwill carrying amount, 41% of these occur within the first year of new leadership.

At best, this analysis suggests that goodwill impairment can be influenced by varying personal opinions of management personnel and their perceptions of outlook and risk.

At the worst, this analysis suggests that there may be an ulterior motive within the decision to impair goodwill. By taking an impairment at the beginning of your tenure as a CEO or CFO, it helps you to a) set a precedent that suggests your predecessor was negligent/ overoptimistic about their acquisitions, or b) influence the share price to fall initially then rise throughout the rest of your tenure.

If this evidence is simply reflective of varying personal opinion about business outlook, it suggests that the goodwill impairment process is not objective. In fact, this critique has been raised regularly to the IASB during the post-implementation review of IFRS 3, the financial standard concerning business combinations.

In March this year, the IASB released a discussion paper on the topic of goodwill impairment due to the feedback received from both preparers and users of financial statements. The users’ feedback is that goodwill impairments provide very little information as they are “too little, too late”. When impairments do occur, it confirms what investors already suspected, rather than providing useful, timely information on the performance of acquisitions.

While impairment is preferred to amortization by the majority of the IASB, it is widely recognised as flawed in practice, due to the subjectivity of the impairment process. So how could goodwill impairment practices be improved to ensure timely impairment of goodwill? An overwhelming request, from experts and from investors, is for greater disclosure surrounding the reporting of both goodwill and other intangible assets.

“I think the framework is there to get it right although it does depend on people being very diligent about what they do and very objective about [...] how the acquired business is actually performing - whether or not it is in line with what you originally thought when you recorded the goodwill – as well as considering the future overall economic outlook and whether your plans for the business are changing. A lot of it comes down to [...] being as objective as you can- even those people who made the decision to acquire the business and have a vested interest in a positive result."

David Matthews, President of the ICAEW

Regarding the specific intangibles which are disclosed alongside goodwill:

“There should be a proper description of what has been valued in each case, what it does and how it provides value and how its life has been assessed; so [for example], what is this technology, is it a grouping of several pieces of technology or is it just one very specific piece of technology?”

Shan Kennedy, Independent IFRS and Valuation Expert and former project director at the UK Accounting Standards Board

Of course, there are model cases of impairments that provide useful information to investors, even if just from a qualitative perspective. In the case of Procter & Gamble, the 2019 impairment demonstrated in chart 9 was part of an US$8 billion impairment to Gillette goodwill and brand value, due to a worsened outlook caused in part by increased competition from disruptive players such as Dollar Shave Club.

While most investors were already aware of this competitive threat, the impairment and accompanying disclosures provide both confirmation of the threat, and informs investors that management are both aware of and acting on that threat.

The Way Forwards

It seems that narrative reporting can be improved relatively simply, by better communication between preparers and users of financial statements, who should make their demands known. A further area for improvement is in the disclosure of quantitative valuation assumptions applied both in impairment testing and intangible asset valuation.

This request is of course more complicated, as preparers of financial statements may be concerned about the scrutiny they may face over their selected assumptions. And those assumptions can have a wildly material impact on the resulting valuation. After time the process would become simpler and could improve the quality of the underlying valuations.

“If there were better disclosure of the figures that had been used, and this applies not just to impairment but to valuation generally, the whole quality of valuations in financial reports would improve dramatically and we would also start to get alignment and consistency across different companies because people would take a look at what their competitors were doing.”

Shan Kennedy, Independent IFRS and Valuation Expert and former project director at the UK Accounting Standards Board

Furthermore, organisations such as the International Valuation Standards Council (IVSC) could play a role in improving the quality of intangible asset valuation. Through years’ of experience, the Brand Finance team have developed standardised approaches to valuation, and were major players in the development of ISO 10668 and 20671 - the international standards on brand valuation and brand evaluation. Other valuation standards also provide guidance on the approach to valuation.

We are now in a pivotal moment for the future of intangible asset reporting. In March 2020, the IASB released a discussion paper on the post-implementation review of IFRS 3, focusing specifically on goodwill and impairment. In the ongoing 3rd agenda consultation, the IASB must determine how to address the topic and the specific projects required surrounding intangible assets.

The IVSC has relaunched the IVS this year, providing updated guidance on intangible asset valuation to practitioners. Intangible Assets (IVS 210) is one of eight asset-specific standards. The latest version of the Standards brings greater depth to the IVS, as recommended by member organisation, including the major accountancy firms and Valuation Professional Organisations.

Change is on the horizon, and we are optimistic about the future of intangible asset reporting.

Brand Finance has been lobbying for greater intangible asset disclosure for about 20 years now. The IVSC supports Brand Finance, and all others, that look to make progress on this most critical issue.

Kevin Prall, Technical Director, IVSC

Recommendations

In an ideal scenario, boards should produce a fair valuation of the business and its constituent assets at each year end- both tangible and intangible. The results should be disclosed in the notes to accounts, and therefore made public to remove information asymmetry. In our view, these valuations should be conducted in line with IFRS 13 (fair value measurement), and by independent practitioners appointed by the board in order to minimise risk to the board members. This concept is not radical; it is akin to portfolio valuations conducted annually by investment trusts and private equity funds about their invested companies.

In order to increase confidence in intangible asset valuation and increase the feasibility of our ideal scenario, there should be better disclosures about impairment reviews and intangible asset valuations. Both the qualitative narrative and disclosure of quantitative assumptions can be improved. For quantitative assumptions, the first step is to disclose the specific assumption used and reduce or eliminate the practice of disclosing ranges of assumptions.

References

- Please note that the views expressed in this report are of the individuals and are not necessarily the official views of the organisations that they represent.

The CEO of the future is changing. The old model of Machiavellian princes fighting over the spoils of the boardroom is out as a wider view becomes essential.

This year we have said goodbye to a host of big-name business leaders. In the finance world, bosses at Credit Suisse, KPMG UK and McKinsey have called it quits.

Perhaps the most famous recent CEO resignation, however, has been Jeff Bezos, leaving the top role at Amazon to take the chairmanship and focus on his other ventures.

Bezos could be seen as the pinnacle of capitalist success, constantly pushing for more and focusing on company value at the expense of almost everything else. However, in an age when people expect large corporations to treat employees well, Bezos has faced growing criticism of Amazon’s treatment of warehouse packing and delivery employees. Reports have found that packing staff avoid proper restroom breaks to meet tight productivity targets, for example.

Reputational crises, like those that cost McKinsey leader Kevin Sneader the top job earlier this year, can place CEOs under immense pressure. Goldman Sachs boss David Solomon, for example, is now face calls to make urgent changes after it was revealed that junior staff in both the UK and US are working epic days, with some reporting they don’t even have time to cook as well as facing abuse from co-workers.

Research by international recruitment company Challenger Gray & Christmas has found that 195 CEOs stepped down in January and February alone this year. And with so many departures, it’s worth asking whether there’s a common thread, whether the nature of the CEO role is being transformed by events and expectations.

To succeed in the long term and help their businesses to thrive, good CEOs now need to be ethical, respectful and reputable. They must balance the needs of all stakeholders – including customers and employees. This requires a wide range of skills including empathy, motivation and charisma, rather than just determination. The pandemic and the need for action on climate change is creating demand for more responsible and purpose-driven business.

Our research suggests that CEO reputation can be negatively impacted by bad behaviour towards civil society and the environment. The CEOs ranked as the best brand guardians take a different approach. Yes, they keep shareholder value front and centre but they plan to deliver this shareholder value in the long-term too. To do so requires awareness of multiple important societal and environmental issues.

Ajay Banga, Mastercard’s soon-to-be executive chairman, for example, has advocated diversity and inclusion by establishing a global female leadership development program for next generation talent and promoting financial inclusion for the “unbanked”. He has also stressed the need to save small businesses during the pandemic, while also ensuring Mastercard remains relevant despite the rise of FinTech challengers during a decade at the top.

Joanne Crevoiserat of Tapestry Inc, the home of luxury lifestyle brands such as Coach and Kate Space New York, brought a customer-centric approach based on the unique needs and advantages of the house of brands and is said to be building a culture of trust and empowerment among her team.

Such successes have encouraged boards to look more closely at the importance of stakeholder management and appoint CEOs who understand why reputation and stakeholder management matter.

We are already seeing a change in the profile of top 100 CEOs. In 2021 there were 10 in the index with a marketing background, for example, compared to just six in 2019. That marks a big change from the traditional finance or, where relevant product/engineering background. Diversity of leadership, which brings with it greater understanding and empathy with a broader range of stakeholders, will mean fewer CEOs with MBAs as well as leadership teams that feature more women and people from diverse racial backgrounds, although the latter two areas still need a lot of work.

It’s our belief that such changes will be accelerated by pressure from activists, regulators, investors and board members. Investors increasingly care about corporate social responsibility about environmental, social and governance issues and they are acting with their wallets. ESG funds captured $51.1 billion of net new money from investors in 2020, a record and more than double the prior year, according to Morningstar.

Being famous is no longer enough for CEOs to succeed. They need to be reputable and show respect to everyone their business touches. And that requires a different approach to management from what we have seen before.

]]>